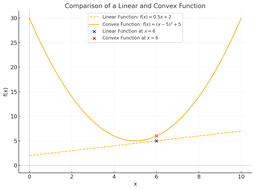

Jensen's inequality states that for a convex function \( f \), the function of the expectation \( f(\mathbb{E}[X]) \) is less than or equal to the expectation of the function \( \mathbb{E}[f(X)] \):

\[ f(\mathbb{E}[X]) \leq \mathbb{E}[f(X)]. \]

This distinction arises because convex functions amplify variability. To understand this difference, let’s explore it in the context of fixed income instruments and options payoffs**.

Fixed Income: Bond Prices and Interest Rates

Consider a bond whose price \( P \) is a convex function of the interest rate \( r \), denoted as \( P(r) \). As \( r \) fluctuates, the convexity of \( P(r) \) means that the average price (expectancy of function) will always be higher than the price at the average rate (function of expectancy):

\[ P(\mathbb{E}[r]) \leq \mathbb{E}[P(r)]. \]

Intuition: The convexity of bond prices arises from the time value of money. If \( r \) increases, bond prices decrease more sharply compared to the gain from an equivalent decrease in \( r \). The variability of \( r \) thus creates a higher expected bond price, demonstrating the amplification effect of convexity.

For a bondholder, this means that market volatility in interest rates increases the expected value of their bond portfolio, highlighting the value of convexity in fixed income markets.

Now consider a European call option with a payoff \( C(S_T) = \max(S_T - K, 0) \), where \( S_T \) is the stock price at maturity and \( K \) is the strike price. The payoff function is convex with respect to \( S_T \). Using Jensen's inequality:

\[ C(\mathbb{E}[S_T]) \leq \mathbb{E}[C(S_T)]. \]

Explanation: If the stock price fluctuates, the convexity of the payoff ensures that the average payoff (expectancy of the function) is higher than the payoff calculated at the

average stock price (function of expectancy). For example:

- If \( \mathbb{E}[S_T] = 105 \), and the option's strike price \( K \) is 100, then \( C(\mathbb{E}[S_T]) = 105 - 100 = 5 \).

- However, if \( S_T \) fluctuates with values like \( 90, 110, 120 \), then \( \mathbb{E}[C(S_T)] \) will exceed 5 due to the higher payoffs at 110 and 120.

This shows that the variability in \( S_T \) increases the expected payoff due to the convex nature of the option’s payoff function.

Why the Difference Matters

The function of expectancy, \( f(\mathbb{E}[X]) \), assumes a world without variability, focusing solely on the average value \( \mathbb{E}[X] \). It ignores the impact of fluctuations,

underestimating the outcomes when \( f \) is convex. On the other hand, the expectancy of the function, \( \mathbb{E}[f(X)] \), captures the amplification effect of variability introduced by

convexity.

In financial contexts, this difference underscores the value of convexity. For fixed income instruments, convexity enhances portfolio returns in volatile interest rate environments. For options, convexity translates into higher expected payoffs, explaining why options can provide significant upside potential relative to their initial cost.

Écrire commentaire