Traders constantly seek edges, subtle cues or indicators that signal the opportune moment to buy or sell. Among the myriad of concepts borrowed from other disciplines, the "Observer Effect," inspired by Heisenberg's Uncertainty Principle in quantum mechanics, has (maybe) found a metaphorical place in trading.

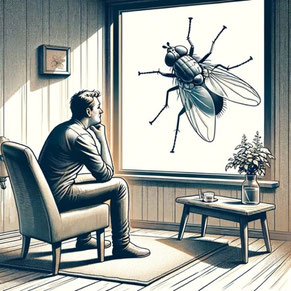

The Uncertainty Principle posits that the act of observing quantum particles like electrons influences their behavior, making it impossible to measure both their position and velocity with absolute precision simultaneously. In the financial markets, a similar phenomenon can occur when traders' actions, based on their observations and analyses, impact the very prices they're trying to predict.

Unlike the quantum world, the markets are swayed by human psychology. When traders en masse believe a stock will rise, their collective buying can drive up the price, thus fulfilling their initial forecast. This self-fulfilling prophecy is a type of observer effect where traders' beliefs and subsequent actions can precipitate market movements.

Technical analysis, which involves studying charts and patterns to forecast future price movements, can also contribute to this observer effect. If a significant number of traders act on similar chart patterns or indicators, their trades can push the market in the anticipated direction, reinforcing the initial analysis.

The rise of algorithmic trading adds a new dimension to the observer effect. Algorithms, programmed to execute trades based on specific market conditions, can amplify market trends. When multiple

algorithms act in concert, the resulting feedback loop can lead to pronounced market movements, often faster than human traders can respond.

Écrire commentaire