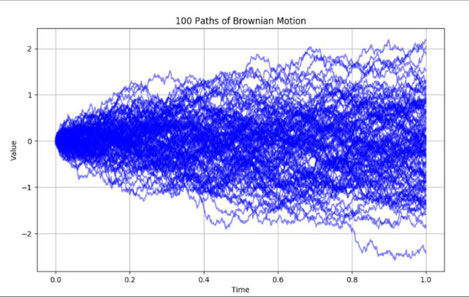

Brownian motion, a term often mentioned in the worlds of physics, mathematics, and finance, can be a puzzling concept to grasp. A seemingly random path that a particle traces in a liquid or gas medium, Brownian motion is often likened to the unpredictable movement of pollen particles in water. At its core, this stochastic process is governed by specific mathematical rules, one of the most intriguing being that its variance is directly proportional to time.

Before delving into its variance-time relationship, it's crucial to understand Brownian motion itself. Named after the botanist Robert Brown, who observed the erratic motion of pollen grains in water under a microscope, Brownian motion serves as a foundational model in stochastic calculus. Its most well-known application might be in the Black-Scholes model in finance, which aids in option pricing.

Key Properties of Brownian Motion

A standard Brownian motion, often symbolized as \( W_t \), has a few defining properties:

- Starting Point: \( W_0 = 0 \). This denotes that Brownian motion always begins at zero.

-

Normal Distribution of Increments: For any two points in time \( s \) and \( t \) where \( s < t \), the increment \( W_t - W_s \) follows a normal distribution:

\( W_t - W_s \sim N(0, t - s) \)

This means the increment has a mean of 0 and a variance of \( t - s \). - Independent Increments: The increments of Brownian motion over non-overlapping intervals are independent of each other.

- Continuity: The path of \( W_t \) is continuous, though it is not differentiable at any point.

Variance-Time Relationship

The intriguing characteristic of Brownian motion is the direct proportionality between its variance and time. Mathematically, this relationship can be expressed as:

\( \text{Var}(W_t) = t \)

In simpler terms, the randomness or spread of the Brownian motion's path increases as we observe it over a longer duration. For a time interval of length \( \Delta t = t - s \), the variance of the increment is:

\( \text{Var}(W_t - W_s) = \Delta t = t - s \)

Example:

Suppose we observe a Brownian motion at times \( t_1 = 2 \) and \( t_2 = 5 \). The variance of the increment \( W_5 - W_2 \) is:

\( \text{Var}(W_5 - W_2) = 5 - 2 = 3 \)

This shows that the spread of the Brownian motion path grows linearly with the observation time.

Applications in Finance

The time-dependent variance of Brownian motion has profound implications, especially in finance. For instance, the Black-Scholes model uses Brownian motion to model the stochastic behavior of stock prices. In this context, the model assumes that the logarithm of a stock price follows a Brownian motion with drift:

\( dS_t = \mu S_t \, dt + \sigma S_t \, dW_t \)

Where:

- \( S_t \): Stock price at time \( t \)

- \( \mu \): Drift, representing the expected return

- \( \sigma \): Volatility, representing the uncertainty or risk

- \( W_t \): Standard Brownian motion

This equation captures the dynamic and uncertain nature of stock price movements. The variance-time relationship of Brownian motion highlights that the longer the time horizon, the greater the uncertainty in stock prices. This growing uncertainty is a critical factor in option pricing, as it influences the risk and potential reward over time.

Example:

Suppose a stock price follows the Black-Scholes dynamics, and we want to calculate the variance of its logarithmic return over a time horizon of \( T = 1 \) year with \( \sigma = 20\% \). The variance of the logarithmic return is:

\( \text{Var}(\ln(S_T/S_0)) = \sigma^2 T = (0.2)^2 \cdot 1 = 0.04 \)

Thus, the standard deviation is:

\( \sqrt{\text{Var}(\ln(S_T/S_0))} = \sqrt{0.04} = 0.2 \) (20%)

This variance-time relationship helps traders and investors evaluate the uncertainty of stock prices over time and manage risk accordingly.

Brownian motion provides a powerful mathematical framework for modeling randomness in various fields, from particle physics to finance. Its key properties—such as independent increments and variance proportionality to time—are essential for understanding its behavior and applications.

In finance, the variance-time relationship highlights the growing uncertainty of asset prices over longer horizons. This insight is crucial for building models that balance risk and reward, enabling more informed investment decisions.

Écrire commentaire