The word "topology" comes from the Greek "topos" (place) and "logos" (study), meaning the study of spaces and their properties. In mathematics, topology focuses on connections and structures within spaces without emphasizing exact distances.

In quantitative finance, topology plays a key role in derivatives pricing by helping model prices, ensure model

stability, and analyze asset behavior. It ensures the continuity of pricing functions, where small changes in input parameters (such as asset price) lead to small changes in derivative

prices.

Topology also supports the convergence of numerical models like binomial trees and Monte Carlo simulations, ensuring

that as calculations increase, they stabilize and approach the correct price of the derivative. Spaces like Hilbert spaces have topological properties that help ensure this convergence to

accurate prices.

A fundamental principle in finance is the absence of arbitrage, meaning there should be no strategy allowing risk-free

profit without initial investment, often by borrowing at the risk-free rate. Topology helps define price structures that prevent arbitrage opportunities. For example, in the Black-Scholes model,

the structure of price paths as continuous Brownian motion helps maintain consistency with no-arbitrage conditions.

Hedging, or risk mitigation, also benefits from topology by ensuring that strategies to offset derivative price changes

are smooth and optimized.

Names like Dirac, Fréchet, Borel, Lebesgue, and Cauchy are prominent in quantitative finance because they laid the

foundational mathematics.

For example, Dirac's delta function is used to model market shocks. The delta function is like a mathematical spike:

zero everywhere except at a single point where it is infinitely tall, representing an instantaneous event like a sudden price change. It helps capture the effect of such singularities without

affecting the overall structure of the model. This allows analysts to model sudden events like an asset price hitting a threshold or a derivative payout.

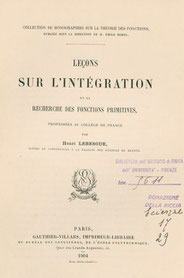

Henri Lebesgue extended the early work of Émile Borel and developed measure theory, which became crucial in defining

measurable functions and probability spaces. His theory of integration, known as Lebesgue integration, revolutionized traditional integral calculus by accommodating "irregular" functions and

providing a more general framework than previous theories, which has proven particularly useful for physicists and financial modelers handling discontinuous or complex payoffs.

Fréchet provided spaces to handle complex functions, Borel developed measure theory for probability spaces, and Cauchy

established concepts of convergence and continuity, which are crucial for stable pricing models.

Image source: Wikipedia

Écrire commentaire