Imagine you're trying to build a toy house using LEGO blocks. The stability of this house depends on the blocks and their arrangement. If you were to build a solid base using the right pieces, the entire house would stand firm. If not, it might wobble or even collapse.

Now, think of financial data like a big matrix (a table of numbers). This matrix might contain information about various assets' returns, risks, and their interrelationships. Just like our LEGO house, we want to understand the structure of this data—specifically, how different assets interact with each other in terms of risk.

Enter the Cholesky Decomposition

Cholesky decomposition is a mathematical technique used to decompose a symmetric, positive-definite matrix into the product of a lower triangular matrix and its transpose:

\[ \Sigma = LL^T \]

Here:

- \( \Sigma \): The covariance matrix of asset returns.

- \( L \): A lower triangular matrix with positive diagonal entries.

- \( L^T \): The transpose of \( L \).

This decomposition allows us to understand the underlying structure of the covariance matrix and its components. In finance, this is particularly valuable for understanding correlations between assets and modeling portfolio risks more accurately.

Example in Portfolio Risk Management

Imagine a portfolio of three assets: Stocks A, B, and C. You are given the covariance matrix of their returns:

\[ \Sigma = \begin{bmatrix} 0.04 & 0.02 & 0.01 \\ 0.02 & 0.03 & 0.015 \\ 0.01 & 0.015 & 0.02 \end{bmatrix} \]

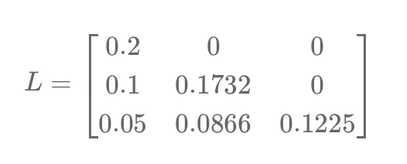

Using Cholesky decomposition, we can decompose \( \Sigma \) into:

\[ L = \begin{bmatrix} 0.2 & 0 & 0 \\ 0.1 & 0.1732 & 0 \\ 0.05 & 0.0866 & 0.1225 \end{bmatrix} \]

This lower triangular matrix \( L \) serves as the building block for generating correlated random variables in Monte Carlo simulations. For instance, if \( Z \) is a vector of independent standard normal variables, we can create correlated random variables \( X \) using:

\[ X = LZ \]

Here, \( X \) represents simulated asset returns that preserve the correlation structure of the original covariance matrix \( \Sigma \).

Application in Monte Carlo Simulations

Cholesky decomposition is essential in generating correlated asset paths for Monte Carlo simulations. For example:

- Risk Assessment: By simulating correlated returns, portfolio managers can evaluate potential portfolio losses under different scenarios.

- Option Pricing: When pricing multi-asset options, such as basket options or spread options, Cholesky decomposition ensures the correlation between underlying assets is accurately represented.

- Stress Testing: Simulated paths generated using Cholesky decomposition can be used to test portfolio resilience under adverse market conditions.

Benefits of Cholesky Decomposition in Finance

- Preserving Correlation Structure: Ensures that simulated returns reflect the true relationships between assets.

- Efficiency: Provides a computationally efficient way to decompose covariance matrices for large portfolios.

- Flexibility: Supports a wide range of financial applications, from portfolio optimization to risk management and derivative pricing.

Limitations

- Positive-Definite Matrices: Cholesky decomposition requires the covariance matrix to be positive-definite. If the matrix is not positive-definite, alternative methods like eigenvalue decomposition may be necessary.

- Market Dynamics: Correlations between assets may change over time, making it necessary to recalibrate the covariance matrix periodically.

Cholesky decomposition is a cornerstone technique in quantitative finance. By breaking down complex data into simpler components, it enables professionals to model risks, simulate scenarios, and make informed investment decisions. Much like understanding the building blocks of a LEGO house, this decomposition provides a deeper understanding of the relationships between assets and their collective behavior.

Écrire commentaire