A reverse convertible is a structured financial product that combines elements of a bond and an option, offering high fixed coupon payments with the risk of potential conversion into shares of an underlying asset rather than a cash return of the principal. These investments are popular among investors seeking enhanced yield, but they come with significant risk tied to the performance of an underlying asset, such as a stock or an index.

How Reverse Convertibles Work

Reverse convertibles typically have a short to medium-term maturity, often between 3 months to 2 years, and provide high periodic coupon payments. These payments are much higher than those offered by traditional fixed-income securities because of the additional risk associated with the product.

The structure of a reverse convertible can be broken down into two key components:

- Bond Component: This is similar to a standard fixed-income security, where the investor lends capital to the issuer and, in return, receives fixed interest payments (coupons) during the life of the product. The coupons are typically attractive, providing a steady income stream.

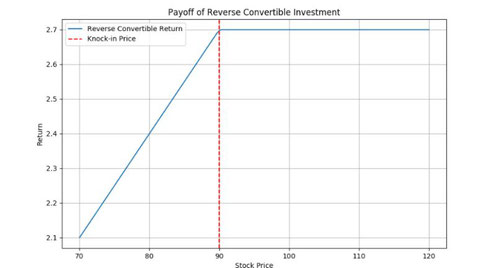

- Option Component (Embedded Derivative): The second component is a short put option on the underlying asset, which exposes the investor to potential downside risk. If the underlying asset's price drops below a certain level (known as the "knock-in" level or "barrier"), the issuer has the right to convert the principal repayment into shares of the underlying asset instead of returning the original investment in cash.

Key Features

- Coupon Payments: These are usually higher than market rates for comparable fixed-income instruments. The high yield compensates the investor for the risk of potentially receiving stock instead of cash at maturity.

- Knock-In Level (Barrier Level): This is a price threshold for the underlying asset, typically set below its initial price (e.g., 70–80% of the asset’s initial value). If, at any point during the life of the product, the underlying asset’s price breaches this level, the investor may receive shares of the underlying asset instead of cash.

-

Maturity Scenarios:

- Above Knock-In Level: If, at maturity, the underlying asset's price is above the knock-in level, the investor typically receives the full principal back in cash, along with the coupon payments collected throughout the term.

- Below Knock-In Level: If the underlying asset has fallen below the knock-in level at maturity, the investor receives shares of the underlying asset equivalent in value to the current market price, which may be worth less than the original principal.

Example of a Reverse Convertible

Suppose an investor purchases a reverse convertible tied to Stock XYZ, which is currently trading at $100. The reverse convertible has a 1-year maturity, offers a 10% coupon, and has a knock-in level at 70% of the initial stock price ($70).

- Scenario 1: If Stock XYZ remains above $70 throughout the year, the investor receives a 10% coupon payment and the full principal back in cash at maturity.

- Scenario 2: If Stock XYZ drops below $70 at any point but recovers to above $70 at maturity, the investor still receives the coupon payment and the principal in cash.

- Scenario 3: If Stock XYZ ends up below $70 at maturity (say, at $60), the investor receives shares of XYZ stock worth $60 instead of the $100 principal, leading to a loss in the original investment.

Advantages and Disadvantages

-

Advantages:

- High Yield: The primary attraction of reverse convertibles is the enhanced coupon payments, which are significantly higher than those of traditional bonds or CDs.

- Market Views: Suitable for investors who have a neutral to moderately bearish view on the underlying asset, expecting limited volatility or minor downward movement.

- Short to Medium-Term Investment: With maturities often between a few months to a couple of years, reverse convertibles provide a relatively short-term investment horizon.

-

Disadvantages:

- Equity Risk Exposure: The investor assumes the risk of a decline in the underlying asset's price. If the knock-in level is breached, the investor may suffer a loss on their principal.

- Limited Upside Potential: While the yield is high, the upside is capped by the coupon payments, meaning the investor does not benefit from any significant increase in the underlying asset’s price beyond protecting the principal.

- Complexity and Lack of Liquidity: The pricing and terms of reverse convertibles can be complex, and they often have limited secondary market liquidity, making it difficult to sell before maturity.

Applications in Finance and Investment Strategies

- Yield Enhancement Strategies: Investors looking to boost income in a low-interest-rate environment may find the high coupon payments of reverse convertibles attractive.

- Neutral to Mildly Bearish Market Outlook: If an investor expects the underlying asset to trade within a certain range (without significant declines), reverse convertibles provide an opportunity to earn enhanced yields without full exposure to downside risk.

- Diversification and Structured Portfolio Strategies: Reverse convertibles can serve as part of a diversified portfolio to complement other fixed-income or equity investments, providing income while adding some exposure to equity-like risk.

Risks to Consider

- Market Risk: A sharp drop in the underlying asset’s price could lead to a significant loss if the knock-in level is breached and the investor receives shares worth less than their original investment.

- Issuer Credit Risk: As with any bond-like instrument, the investor is exposed to the credit risk of the issuer. If the issuer defaults, the investor may not receive coupon payments or principal.

- Complexity and Fees: Understanding the terms of reverse convertibles requires careful attention to detail, including coupon structures, knock-in levels, and potential conversion terms. Additionally, these products may carry fees or spreads that reduce overall returns.

Reverse convertibles are structured products offering high yield potential and exposure to an underlying asset’s price movements. While they provide an attractive income stream, they carry risks associated with market volatility, issuer creditworthiness, and the potential for conversion into shares. Investors considering reverse convertibles should have a clear understanding of the product’s structure, benefits, and risks, and ensure that their market outlook and risk tolerance align with the features of these instruments.

Écrire commentaire