"Pricing" a vanilla interest rate swap involves determining the "swap rate" which is the fixed rate that equates the present value (PV) of all expected future floating cash flows with the PV of all future fixed cash flows. This ensures the swap's value is zero at inception aligning with the fundamental principle of no arbitrage (NA)1. This principle dictates that a derivative's price must prevent either party from being unfairly advantaged or disadvantaged.

The relationship can be expressed as:

Swap Value = Value of Fixed Rate Bond (VP) - Value of Floating Rate Bond (VFL)

Key Analogies

Receiving the fixed rate is akin to investing in a fixed rate bond (\(VP\)) i.e. being the lender.

Paying the floating rate is akin to issuing a floating rate bond (\(VFL\)) i.e. being the borrower.

Floating Leg Value (VFL)

\[ VFL = 1 \]

This is because at each coupon payment date the floating rate resets and the bond's value reverts to its par value. Essentially it is equivalent to issuing a new bond at each reset date at the prevailing floating rate with a repayment value of 1.

Fixed Leg Value (VP)

The value of the fixed rate bond is calculated as:

\[ VP = \frac{C}{(1 + t_1)} + \frac{C}{(1 + t_2)^2} + \dots + \frac{C}{(1 + t_n)^n} + \frac{P}{(1 + t_n)^n} \]

Where:

- \(C\): The coupon rate of the fixed rate bond.

- \(P\): The principal or face value (typically 1).

- \(t_1, t_2, \dots, t_n\): Discount factors based on spot rates for each period.

Discount Factor (DF)

The discount factor for each period is given by:

\[ DF = \frac{1}{(1 + t_i)^i} \]

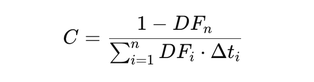

Solving for the Fixed Coupon Rate (C)

The fixed coupon rate (\(C\)) is determined such that the bond is priced at par value (1) and redeemed at par at maturity (\(P = 1\)).

\[ C = \frac{1 - DF_n}{DF_1 + DF_2 + \dots + DF_n} \]

Example Calculation

Swap Term 3 years; Fixed Coupon Payments Annually

Spot Rates:

- Year 1 \(5\%\)

- Year 2 \(5.5\%\)

- Year 3 \(6\%\)

Step 1 Calculate Discount Factors (DF)

\[ DF_1 = \frac{1}{1 + 0.05} = 0.9524, \quad DF_2 = \frac{1}{(1 + 0.055)^2} = 0.8984, \quad DF_3 = \frac{1}{(1 + 0.06)^3} = 0.8396 \]

Step 2 Floating Leg Value (VFL)

\[ VFL = 1 \]

Step 3 Fixed Leg Value (VP)

\[ VP = (C \cdot 0.9524) + (C \cdot 0.8984) + (C \cdot 0.8396) + (1 \cdot 0.8396) \]

\[ C \cdot (0.9524 + 0.8984 + 0.8396) + 0.8396 = 1 \] \[ C \cdot 2.6904 + 0.8396 = 1 \] \[ C \cdot 2.6904 = 0.1604 \] \[ C = \frac{0.1604}{2.6904} \approx 0.0596 \]

Notes:

1 The no arbitrage principle ensures that no risk free profit opportunities exist in financial markets.

Écrire commentaire