Exotic options are financial derivatives with features that differ from standard options, offering tailored solutions for specific market needs. One popular type is the barrier option, whose value depends on whether the price of the underlying asset reaches a predetermined level known as the barrier. A subset of these is the knock-out (KO) option, which becomes void if the barrier level is reached. This feature makes knock-out options cost-effective compared to standard options while aligning with traders' strategic goals.

Many customers prefer barrier options, like knock-out options, because they are cheaper and allow users to eliminate unwanted exposure when it is no longer needed. Specific use cases of knock-out options include the following:

- Funds Managers: Fund managers often use knock-out options to reduce hedging costs. For example, they might purchase put options to protect their stock holdings but set a knock-out barrier at 5% above the market price. This reflects their confidence that they would no longer need protection in a rally and avoids overpaying for unnecessary coverage.

- Speculators: Speculators favor knock-out options to express directional views on market trends. For instance, a speculator may purchase an out-of-the-money call option with a knock-out barrier just below a critical support level. This aligns with their belief in the persistence of trends while reducing costs if the market moves against their expectations.

- Corporates: Companies with contingent exposures may use knock-out options to manage risks while minimizing hedging costs. For instance, a corporate client might use knock-out options to hedge currency risks, canceling the option if favorable market movements occur.

Knock-out Option Use Case Example:

Bank's Position:

- The bank has sold a knock-out (KO) call option to the trader.

- Underlying Asset: Stock ABC

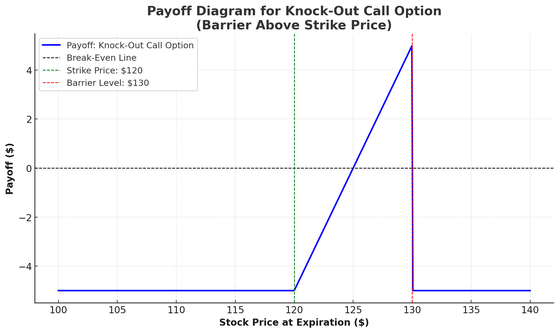

- Option Details: KO call option with a strike price of $120 and a barrier level of $130.

- Expiry: 6 months

Trader's Position:

- The trader has bought the KO call option from the bank.

- The trader is bullish on Stock ABC and believes the price will rise up to the barrier, ready to forgo upside potential beyond it for a lower premium cost.

Hedging Strategies by the Bank:

Step 1: Identifying Risks

The bank identifies that while it does not have a payout obligation if the KO option is knocked out due to the barrier being reached, it is exposed to the risk of potential losses associated with the sold KO call option.

Step 2: Managing Vega, Skew, and Vanna Risk

The bank is concerned about vega risk (sensitivity to changes in implied volatility) and exposure to the volatility skew due to the combination of different strike levels in the options (strike and barrier).

The bank also inherits a risk known as vanna, which refers to the sensitivity of the option’s delta to changes in implied volatility. To manage vega risk and skew exposure, the bank employs a risk reversal strategy. The sold put helps mitigate vanna risk arising from selling KO options. As the stock price moves, the vanna risk in the sold put is offset by the vanna in the bought call, leading to a more stable overall position.

Step 3: Risk Reversal Strategy

- Buying Call Options: The bank buys call options on Stock ABC with a similar expiry and strike price as the sold KO call option. This introduces a long vega position, helping offset potential losses from the sold KO call option due to increased implied volatility.

- Selling Put Options: The bank sells put options on Stock ABC with the same expiry and a strike price of $120. This introduces a short vega position and helps manage skew exposure from the combination of different strike levels.

Step 4: Potential Outcomes at Barrier Reach

Barrier Not Reached:

- If the price of Stock ABC does not reach the barrier level of $130, the KO call option remains active until its expiry.

- The bank monitors its vega and skew risk exposures through the combined positions of the sold KO call option, the bought call options, and the sold put options from the risk reversal strategy.

Barrier Reached:

- If the price of Stock ABC rises to or beyond the barrier level of $130, the KO call option is knocked out, and the trader loses the right to exercise it.

- The bank does not have a payout obligation in this scenario but still faces the risk of potential losses associated with the sold option.

- The risk reversal strategy helps the bank manage vega risk and skew exposure.

Through careful hedging, the bank reduces its exposure to volatility risks while maintaining a stable position in the dynamic market created by the sold KO call option.

Knock-out options are attractive for specific users due to their reduced costs and path dependency. Fund managers often use them to lower hedging expenses, especially when protection is only needed under particular conditions. Speculators and corporates also use KO options to express views on market trends or manage contingent exposures while minimizing costs.

Écrire commentaire