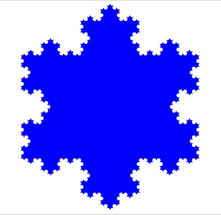

Benoit Mandelbrot, with his work on fractals, challenged conventional financial models by revealing the complex, rough patterns of market prices that mimic fractal geometry—self-similar across

different time scales. Unlike the smooth paths predicted by models like Black-Scholes, real market movements are jagged and discontinuous, similar to fractal shapes, which remain complex

regardless of the scale.

Mandelbrot’s insights came partly from Hurst's research on the Nile River's flood patterns, which exhibited self-similarity, a characteristic of fractals. In finance, Mandelbrot saw that price

movements had this same quality—large swings often followed large swings, defying the rare event prediction of normal distributions.

Fractals are indicative of "wild randomness" as opposed to the "mild randomness" assumed by standard financial models. This perspective recognizes more frequent large jumps in market prices, akin

to the Nile's erratic floods.

Using the Hurst exponent, a measure derived from studying the Nile, Mandelbrot quantified the persistence of market trends, suggesting financial models should embrace fractal geometry to more

accurately describe market behavior. This approach accounts for heavy tails and volatility clustering seen in empirical market data—features inadequately explained by the normal

distribution.

In fractal-based finance, markets possess a memory effect, where past large changes influence the likelihood of future volatility, creating patterns that defy the random walk hypothesis of market

price movements.

This fractal view aligns with the properties of Brownian motion—a model used to describe the random trajectory of particles that also applies to financial price movements. Despite its continuous

path, Brownian motion doesn't have a defined slope at any point, embodying the unpredictability of markets at every moment. This is akin to fractal roughness: no matter how closely you look, the

irregularity persists.

Thus, fractals offer a lens to view markets as complex systems with self-similarity across scales and a tendency for "wild" rather than "mild" randomness, challenging the assumption of constant

volatility and leading to more robust financial modeling.

Écrire commentaire