The Black-Scholes model is widely known for calculating the theoretical value of European-style options, assuming that stock prices follow a lognormal distribution. Within this model, a key component is \( d₁ \), a term that captures several important aspects of option pricing. Understanding \( d₁ \) is crucial for gaining insight into how options behave and are valued.

The Formula for d₁

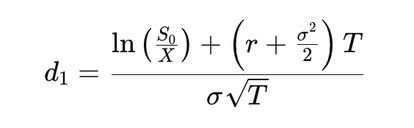

The \( d₁ \) term is defined as:

\( d₁ = \frac{\ln(S₀/X) + (r + \frac{\sigma²}{2})T}{\sigma \sqrt{T}} \)

Where:

- \( S₀ \): Current stock price

- \( X \): Option strike price

- \( T \): Time to expiration (in years)

- \( r \): Risk-free interest rate (annualized)

- \( \sigma \): Volatility of the stock (annualized)

Key Components of d₁

- Natural Logarithm of the Stock to Strike Ratio: The term \( \ln(S₀/X) \) measures the relative position of the stock price to the strike price. If \( S₀ > X \), the logarithm is positive, indicating the option is "in the money." If \( S₀ < X \), it is negative, meaning the option is "out of the money." The natural logarithm converts the ratio into a scale that reflects compounded returns over time.

- Risk-Free Rate Compensation: The term \( rT \) accounts for the time value of money. It reflects the opportunity cost of holding cash instead of investing it in a risk-free asset over the option's lifespan.

- Volatility Adjustment: The term \( (\sigma² / 2)T \) adjusts for the expected variance in stock price movements due to volatility \( \sigma \). This factor arises from geometric Brownian motion, which governs stock price behavior in the Black-Scholes model.

- Denominator (Volatility Adjusted for Time): The denominator \( \sigma \sqrt{T} \) standardizes \( d₁ \) by accounting for the stock's volatility and the time to expiration. It ensures that \( d₁ \) remains a dimensionless measure.

Example:

Suppose a stock's current price \( S₀ = 100 \), the strike price \( X = 110 \), time to expiration \( T = 1 \) year, risk-free rate \( r = 5\% \), and volatility \( \sigma = 20\% \). Substituting these values into the formula:

\( d₁ = \frac{\ln(100/110) + (0.05 + \frac{0.2²}{2}) \cdot 1}{0.2 \sqrt{1}} \)

Simplify:

\( d₁ = \frac{-0.0953 + 0.07}{0.2} = \frac{-0.0253}{0.2} = -0.1265 \)

Here, \( d₁ \) is negative, reflecting that the stock price is below the strike price.

N(d₁): The Option’s Delta

The cumulative normal distribution function \( N(d₁) \) gives the probability that a standard normal variable is less than \( d₁ \). In the Black-Scholes model, \( N(d₁) \) represents the delta of a European call option, which measures the sensitivity of the option's price to changes in the underlying stock price.

Delta indicates how much the option's price is expected to change for a $1 change in the stock price. For example, if \( N(d₁) = 0.4 \), the option's price would increase by $0.40 for every $1 increase in the stock price.

Example:

Using the previous calculation where \( d₁ = -0.1265 \), we can compute \( N(d₁) \) using standard normal tables or software. For \( d₁ = -0.1265 \):

\( N(d₁) \approx 0.4495 \)

This means the delta of the call option is approximately 0.45, indicating that the option's price will increase by $0.45 for a $1 increase in the stock price.

Common Misconception: N(d₁) vs. N(d₂)

While \( N(d₁) \) represents the delta, \( N(d₂) \) is the risk-neutral probability of the option expiring in the money. The distinction is critical:

- \( N(d₁) \): Measures the sensitivity of the option price to changes in the stock price.

- \( N(d₂) \): Represents the probability of the option being exercised profitably at expiration under a risk-neutral framework.

Key Insights

The \( d₁ \) term in the Black-Scholes model encapsulates the key factors affecting option pricing, including stock price, strike price, volatility, time, and interest rates. \( N(d₁) \), as the delta, provides insights into the option’s sensitivity and serves as a cornerstone for hedging strategies. Distinguishing \( N(d₁) \) from \( N(d₂) \) helps clarify the distinct roles these terms play in understanding and managing options.

Écrire commentaire