Functioning of derivatives

Functioning of derivatives · 07. mars 2025

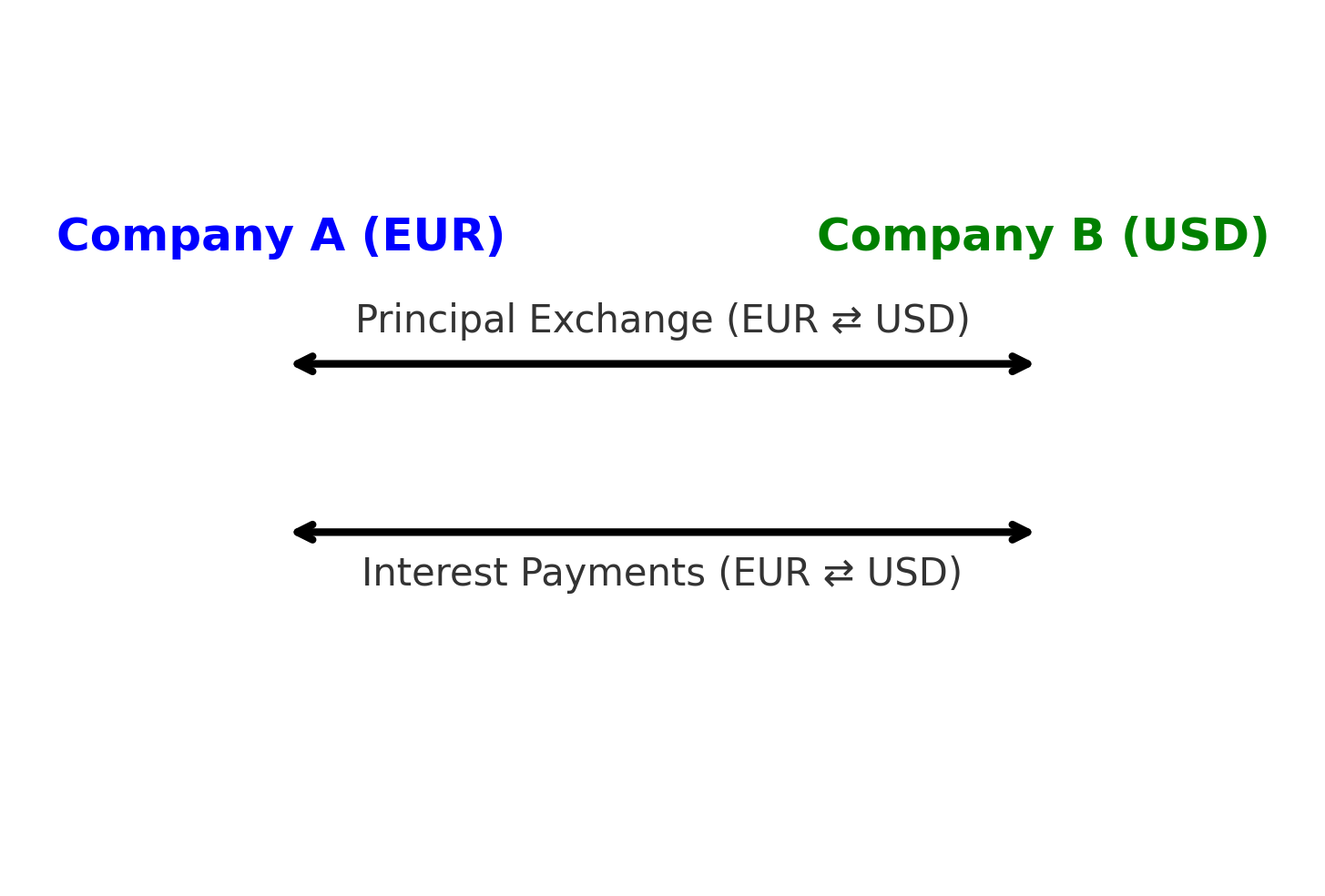

Currency swaps are financial agreements that help companies manage foreign exchange risks and optimize borrowing costs. These swaps allow businesses to exchange payment flows between different currencies while benefiting from more favorable interest rates.

Functioning of derivatives · 19. février 2025

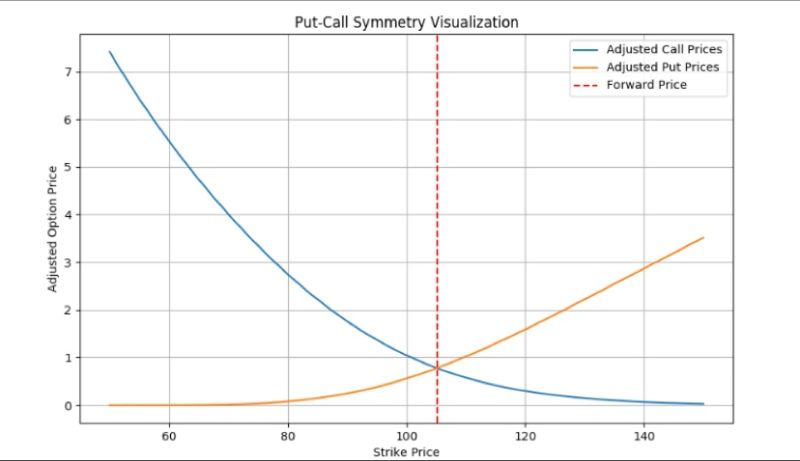

La volatility skew désigne les variations de la volatilité implicite en fonction du prix d'exercice des options. Contrairement à l'hypothèse de volatilité constante du modèle de Black-Scholes, les marchés réels présentent des écarts de volatilité qui traduisent la peur des investisseurs, la demande de couverture et des asymétries de risque.

Sur le marché des devises, on observe souvent un volatility smile, qui reflète l'équilibre des risques entre l'appréciation et la dépréciation des monnaies.

Functioning of derivatives · 02. juin 2024

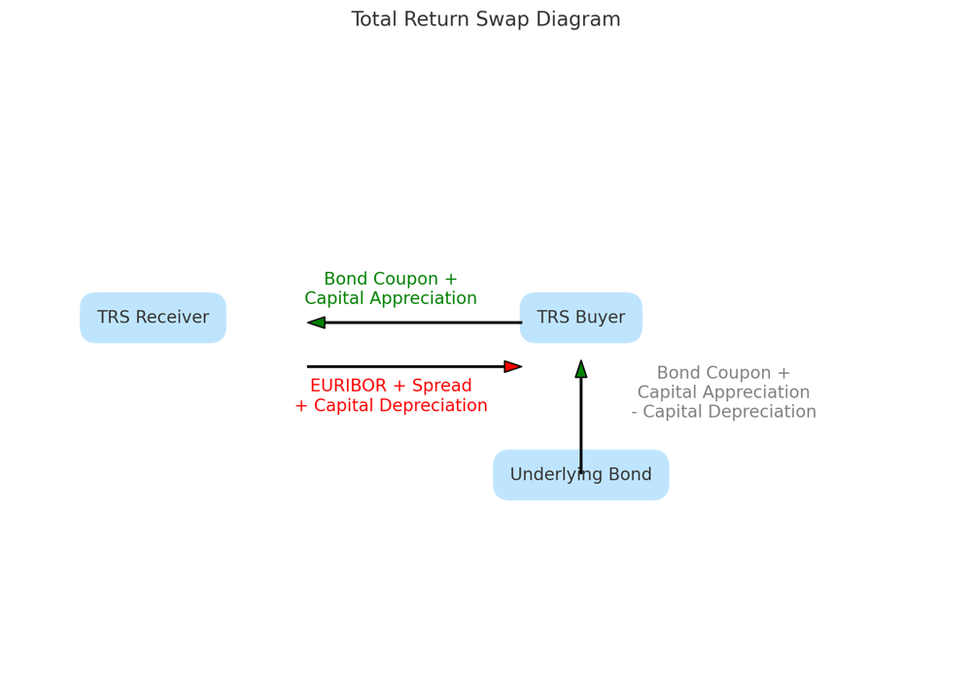

A Total Return Swap (TRS) is a derivative allowing one party to receive the total return of a credit asset (interest, principal, and capital gains/losses), while the other party receives regular payments based on a fixed or floating rate like EURIBOR. TRS enable credit risk transfer, leveraged exposure to fixed income, and synthetic access to illiquid assets, commonly used for hedging, regulatory capital management, and investment strategies.

Functioning of derivatives · 05. novembre 2023

Put-Call Symmetry (PCS) links European put and call option prices via the forward price of the underlying asset. It requires frictionless markets, no arbitrage, zero drift, and symmetric asset returns. PCS is practical for pricing and hedging exotic options, offering a simpler alternative to dynamic hedging by balancing put and call strike prices against the forward price.

Functioning of derivatives · 01. avril 2023

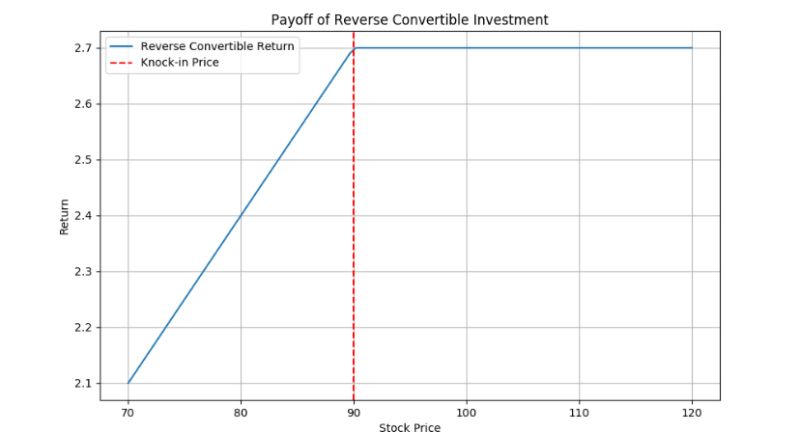

Reverse convertibles sound complex but think of them as a two-in-one deal. You get higher interest, but there's a stock bet involved. If the stock stays steady or rises, you enjoy the interest. However, if it drops significantly, you could end up owning that stock instead. You can add a safety layer, called 'hedging', to protect your investment. But remember, while you can earn decent returns, you might miss out on big stock gains.

#InvestmentBasics #ReverseConvertible #FinanceTips