Statistics · 10. décembre 2024

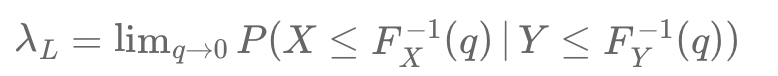

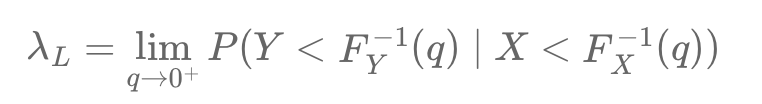

Gaussian copulas fail to capture extreme co-movements, a limitation revealed during the 2008 crisis. While Pearson correlation measures average linear relationships, it overlooks tail dependencies. Tail dependence coefficients (\( \lambda_U \), \( \lambda_L \)) quantify the probability of simultaneous extremes, critical in financial stress. Senior CDO tranches, seen as low-risk under Gaussian models, suffered heavy losses due to hidden tail risks with junior tranches.

Mathematical Principles and Quantitative Finance · 30. septembre 2024

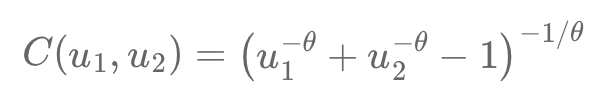

Copulas help model dependencies between variables separately from their behaviors, crucial for finance's complex relationships. For example, Alice and Bob’s race times show dependency when transformed into uniform variables using cumulative distribution functions (CDFs). The Clayton copula captures asymmetric dependence, especially in lower tail risks, using the formula:

C(u1, u2) = (u1^(-θ) + u2^(-θ) - 1)^(-1/θ).

Mathematical Principles and Quantitative Finance · 28. février 2024

Risk assessment in CDOs involves probability theory for individual defaults and correlation analysis for linked defaults. CDOs have senior, mezzanine, and equity tranches with varying risks. High correlation suggests simultaneous defaults and larger losses, while low correlation indicates independent defaults, impacting different tranches.

#CDOsExplained #RiskAssessment #DefaultFrequency #ProbabilityTheory