Risk Management · 16. février 2025

Wrong-way risk arises when a counterparty’s likelihood of default increases precisely when a bank’s exposure to it is also rising, amplifying financial risk. This is particularly relevant in derivatives and financing transactions where market fluctuations drive exposure.

Unlike traditional credit risk, which is one-sided, counterparty credit risk in derivatives is bilateral and dynamic, changing with market conditions.

Stochastic Models and Processes · 12. novembre 2023

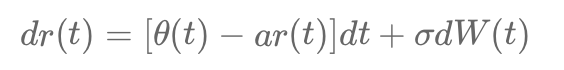

The Hull-White model is a versatile framework for modeling short-term interest rates and credit risk. It captures the stochastic behavior of rates or hazard rates, ensuring flexibility and accuracy in pricing derivatives like bonds and Credit Default Swaps (CDS). By modeling hazard rates, the model calculates survival and default probabilities, enabling dynamic risk assessment.