Risk Management · 16. février 2025

Wrong-way risk arises when a counterparty’s likelihood of default increases precisely when a bank’s exposure to it is also rising, amplifying financial risk. This is particularly relevant in derivatives and financing transactions where market fluctuations drive exposure.

Unlike traditional credit risk, which is one-sided, counterparty credit risk in derivatives is bilateral and dynamic, changing with market conditions.

Risk Pricing · 10. juin 2024

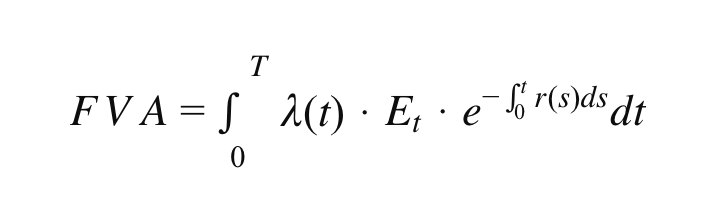

The Funding Valuation Adjustment (FVA) reflects the funding cost of uncollateralized derivatives above the risk-free rate, typically €STR or OIS in Europe. When a bank hedges an uncollateralized swap with a collateralized market swap, the difference between the internal funding cost and the benchmark rate results in either a negative or positive FVA. This adjustment directly affects the overall cost of hedging transactions.

Mathematical Principles and Quantitative Finance · 07. février 2024

Explore the hypercube's critical role in CDO risk modeling within quantitative finance. A hypercube extends a 2D square or 3D cube into an N-dimensional space, each axis representing a financial asset's cumulative distribution in copula functions. It's pivotal for visualizing complex dependencies in a CDO, where each axis indicates the default probability of different assets.