Mathematical Principles and Quantitative Finance · 28. février 2025

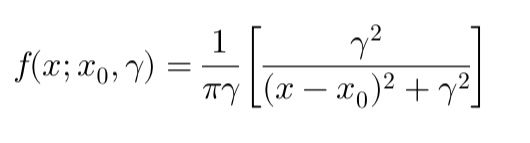

The Cauchy distribution challenges traditional financial models due to its infinite variance and heavy tails. Unlike the mean, which does not exist, the median is a more reliable measure for analyzing returns. This impacts portfolio diversification and risk models, making metrics like standard deviation ineffective. To better manage uncertainty, use the Interquartile Range (IQR) and Conditional Value at Risk (CVaR) for more robust risk assessment.

Stochastic Models and Processes · 08. septembre 2023

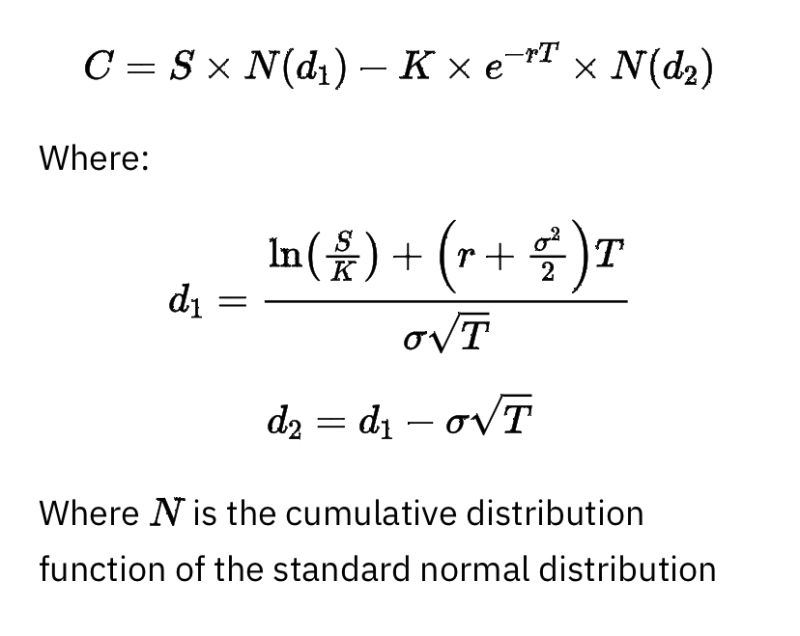

Unpack the myth that option Delta equals the probability of expiring in-the-money. Dive into risk-neutral valuation and the Black-Scholes model, where assets grow at a risk-free rate, making Delta an unreliable real-world probability indicator. Explore the distinction for smarter option trading. #OptionTrading #BlackScholes #RiskNeutralValuation