Stochastic Models and Processes · 13. novembre 2023

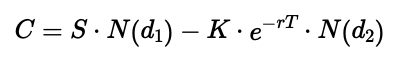

In the Black-Scholes formula, Δ is the option delta, showing the price change of a call option for a $1 change in the stock price. Δ equals N(d1), where N is the cumulative normal distribution function, and d1 factors in the stock price, strike price, time to expiration, risk-free rate, and volatility.

#OptionsTrading #Delta #BlackScholesModel

Pricing and Valuing Financial Instruments · 10. juin 2023

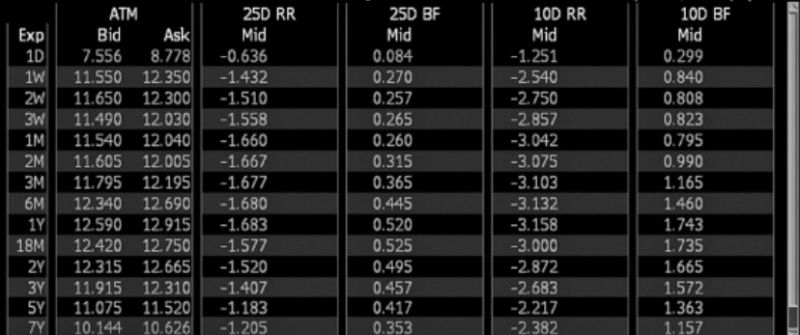

In the world of foreign exchange (FX), two indicators help traders decode market mood: Risk Reversal (RR) and Butterfly (BF) volatilities. Imagine RR as a compass, pointing to bullish or bearish winds by comparing the price expectations of currency going up (call options) to it going down (put options). On the other hand, BF is like a barometer, forecasting calm or stormy weather by measuring the expected price stability of currencies.