Stochastic Models and Processes · 13. novembre 2023

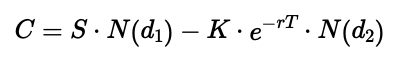

In the Black-Scholes formula, Δ is the option delta, showing the price change of a call option for a $1 change in the stock price. Δ equals N(d1), where N is the cumulative normal distribution function, and d1 factors in the stock price, strike price, time to expiration, risk-free rate, and volatility.

#OptionsTrading #Delta #BlackScholesModel

15. juillet 2023

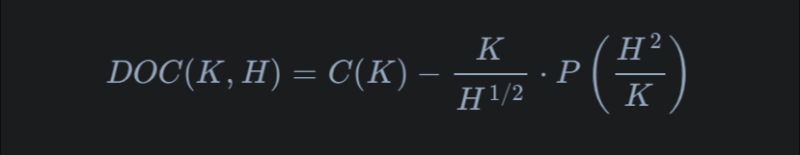

In simple terms, think of hedging like insurance. A bank sold a specific type of "insurance" (Down-and-Out European Call) that pays out only if the stock price doesn't dip below a certain level (the barrier). To safeguard itself, the bank uses a mix of buying and selling other financial "insurances" (call and put options). The magic formula ensures that if the stock dips below the barrier, the bank won't lose money. It's a balancing act, where buying one thing counteracts the selling of another