13. novembre 2023

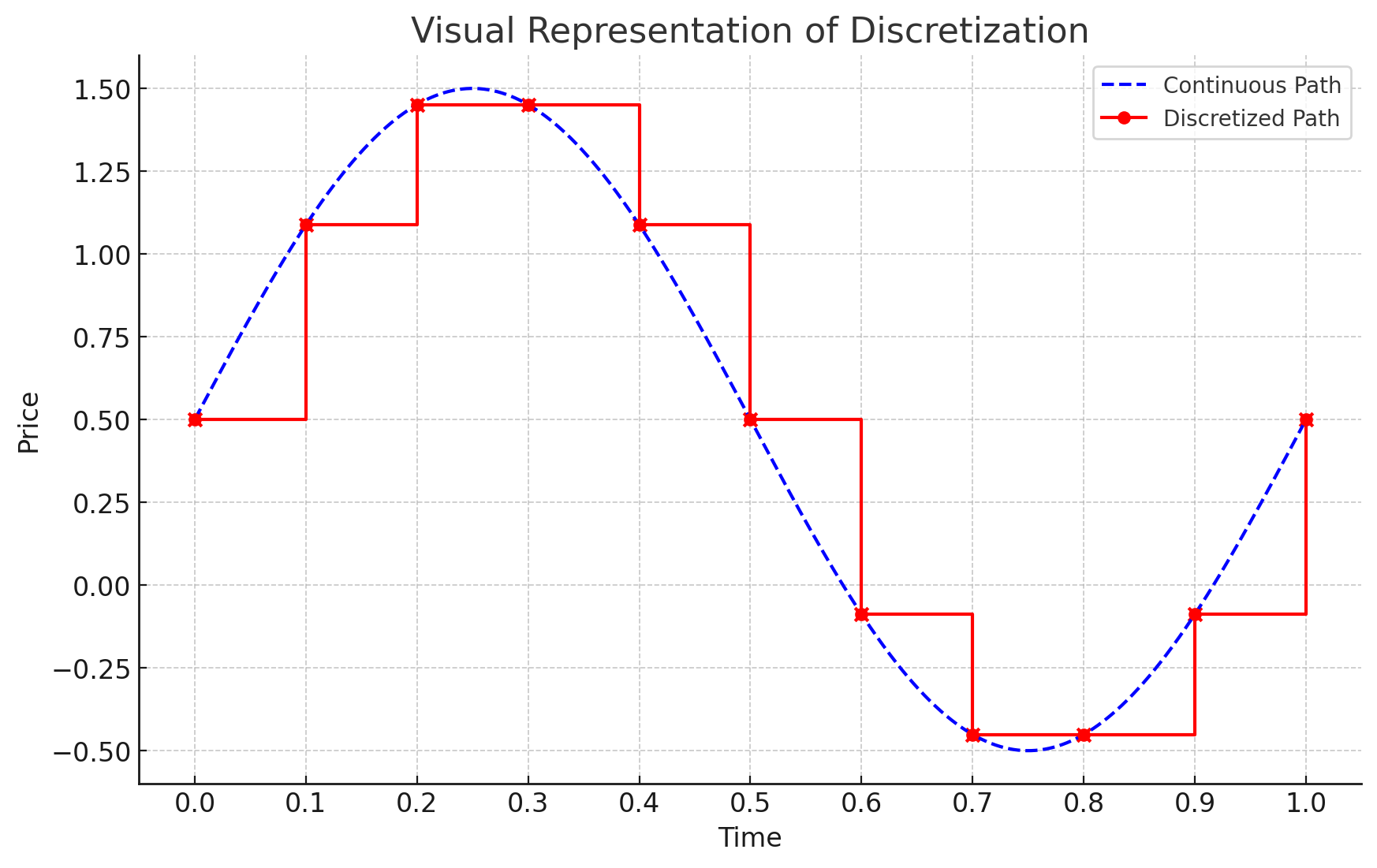

Discretization translates continuous financial models into numerically solvable steps, crucial for derivative pricing and risk management. It simplifies complex models, enabling simulations like Monte Carlo for exotic options while introducing some approximation error. #QuantitativeFinance #DerivativesPricing #NumericalMethods

Mathematical Principles and Quantitative Finance · 09. novembre 2023

An SPD matrix, with only non-negative eigenvalues, represents systems free from "negative energy" and ensures non-negative outcomes in various applications, including finance. It guarantees that any real vector, when applied to a quadratic form like portfolio variance, yields a non-negative result. SPD matrices are key in constructing risk models, pricing options, and in stochastic calculus, providing a reliable framework for financial analysis, optimization, and derivatives pricing.

Mathematical Principles and Quantitative Finance · 01. novembre 2023

The Crank-Nicolson Method, pivotal in quantitative finance, adeptly solves PDEs for option pricing and interest rate modeling. It splits time and space into grids, balancing calculations between current and next steps (implicit and explicit). It's stable and precise, essential for real-world financial scenarios.

Mathematical Principles and Quantitative Finance · 01. novembre 2023

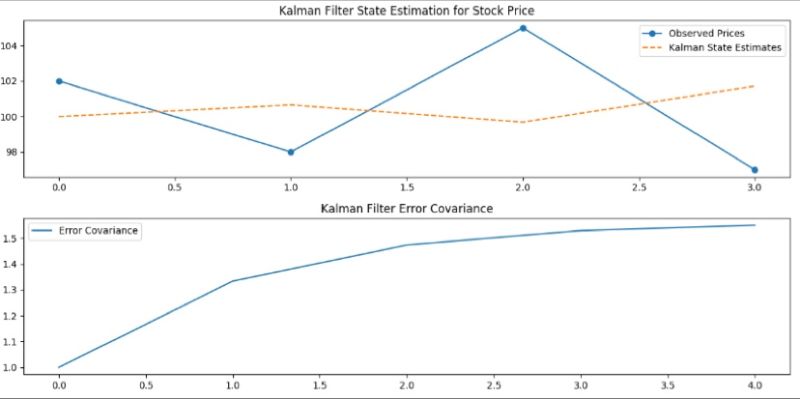

The Kalman filter refines estimates of financial states like stock prices from noisy data, crucial for asset tracking and trend analysis. It uses initial guesses and uncertainty measures, adjusting predictions with observed data over time. Kalman Gain balances predictions with actual trends for optimal estimation.

Principes mathématiques et applications en finance · 02. octobre 2023

Analytical methods offer exact solutions via mathematical formulas, ideal for simpler problems. E.g., Black-Scholes Model for option pricing. Numerical methods, like Monte Carlo simulations, provide approximate solutions for complex, real-world problems, but can be computationally intensive.

Mathematical Principles and Quantitative Finance · 08. septembre 2023

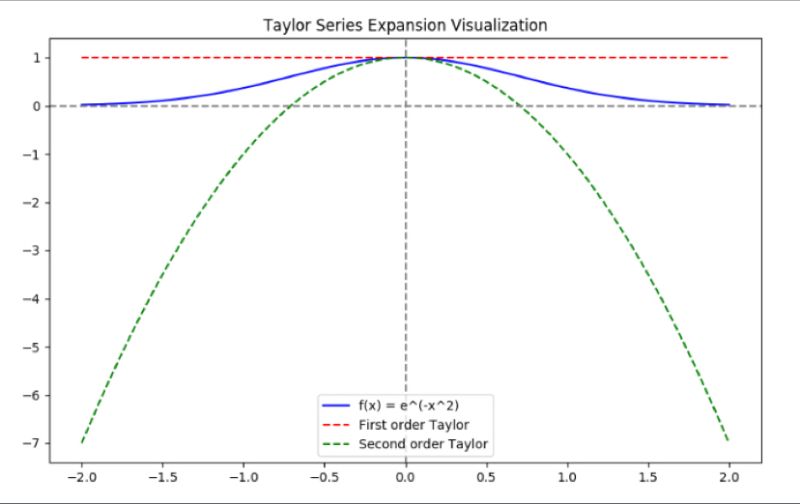

Taylor's expansion is an essential tool in quantitative finance for simplifying complex models, useful for quick decision-making, trading, and sensitivity analysis. It allows for the local approximation of a function through its derivatives, making it easier to understand its behavior.

Mathematical Principles and Quantitative Finance · 22. juillet 2023

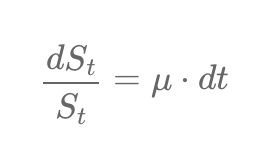

Differentiation helps forecast future stock prices. The equation dS/dt = μ * St indicates that a stock's price change is linked to a "drift" rate, μ. By adjusting and solving this equation, we get St = S₀ * e^(μt), a formula that predicts a stock's growth over time based on this drift. It's a mathematical way to gauge how stock prices evolve.

Mathematical Principles and Quantitative Finance · 18. mars 2023

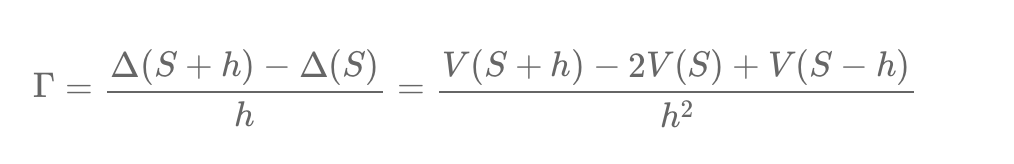

Navigating options is like hiking. To gauge a trail's steepness, you take small steps and check the height difference. This is the "slope" in hiking or the "delta" in options. But trails can vary in steepness, akin to the "gamma" in options. The finite difference method is our way of taking these small steps, offering insights into options without needing a full formula. Simply put, it's understanding changes step-by-step, just as in hiking. 🌄💹🚶♂️📊 #FiniteDifferenceMethod #OptionsInsight