Stochastic Models and Processes · 01. novembre 2023

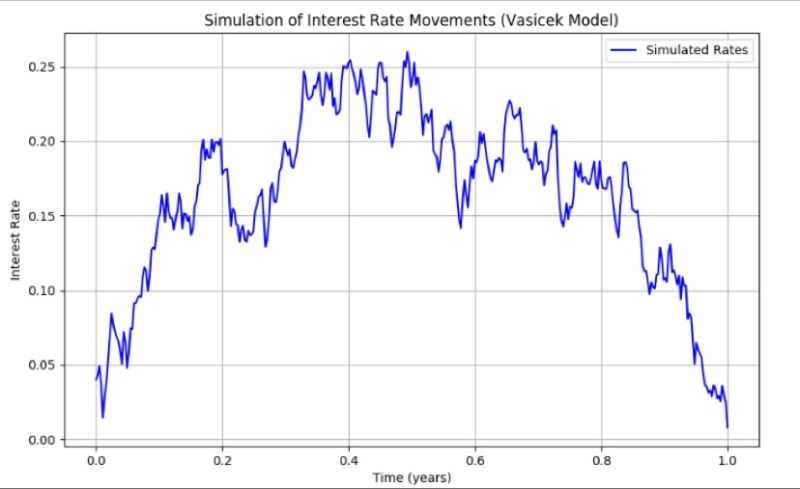

The Vasicek model predicts interest rates using mean reversion, volatility, and the speed of reversion. Its equation, dr(t) = κ(θ - r(t)) dt + σ dW(t)`, models rates' return to a mean (θ) with volatility (σ) and randomness (dW(t)). It's vital for financial strategies and simulations.