Mathematical Principles and Quantitative Finance · 25. décembre 2024

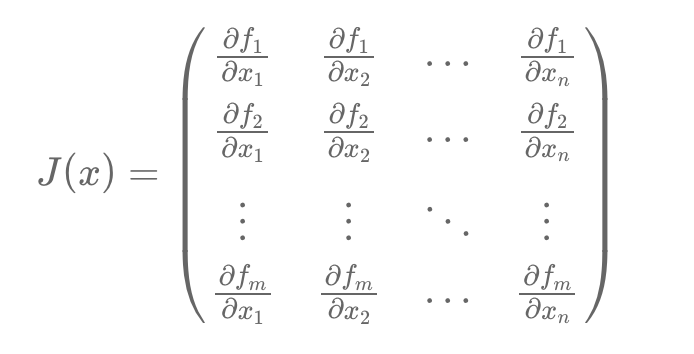

Discover how the Jacobian Matrix plays a crucial role in quantitative finance, from pricing bonds and risk management to sensitivity analysis and yield curve modeling. This article breaks down the mathematical principles behind the Jacobian Matrix and demonstrates its practical applications in analyzing interest rate movements, par rates, and zero rates.

Mathematical Principles and Quantitative Finance · 29. juin 2024

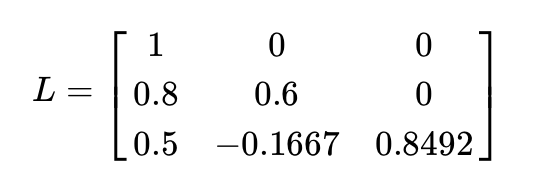

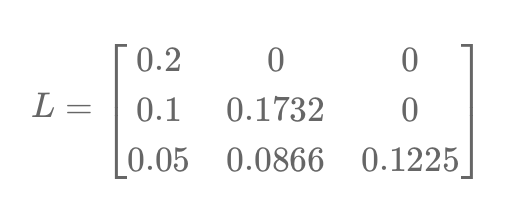

Cholesky decomposition plays a critical role in pricing Collateralized Debt Obligations (CDOs) by transforming independent variables into correlated ones based on a given correlation matrix. This method helps simulate scenarios of correlated defaults, essential for assessing risks and determining expected losses in CDO tranches.

Mathematical Principles and Quantitative Finance · 09. novembre 2023

In quant finance, eigenvalues and eigenvectors distill risk and trends in portfolio analysis. They're crucial in PCA, reducing complex asset return data to key risk factors. For instance, eigenvectors direct to axes showing variance, while eigenvalues quantify it, revealing how assets move together.

#EigenvaluesInFinance #EigenvectorsExplained #PrincipalComponentAnalysis #CovarianceMatrix

Mathematical Principles and Quantitative Finance · 24. septembre 2023

Unlock portfolio risk management with linear algebra & copula in layman’s terms. Master the art of pairs trading & optimize your asset allocation using easy steps. Dive into expected returns, covariance & portfolio weights. Mobile-friendly, updated insights! #FinanceEducation #RiskAnalysis

Mathematical Principles and Quantitative Finance · 25. mars 2023

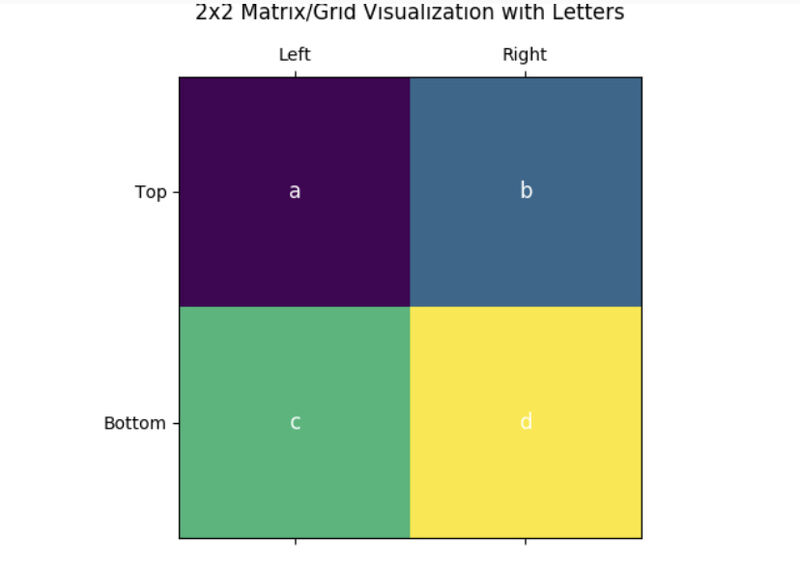

When trying to grasp the determinant of a matrix, envision a 2x2 grid, with values 'a' to 'd'. Picture it as arrows on a surface. The first column points as (a,c) and the second as (b,d). They form a slanted rectangle, a parallelogram. The formula 'ad - bc' signifies this shape's area. If negative, imagine viewing the shape from the opposite side. In essence, the determinant measures the space this shape occupies. Think of it as the "area" of the matrix's influence #MatrixDeterminant #MathBasic

Mathematical Principles and Quantitative Finance · 25. février 2023

Cholesky decomposition, in essence, breaks down complex financial data to simplify understanding of risk interplay between assets. Picture this as disassembling a LEGO house to discern how each block contributes to its stability. In finance, this "deconstruction" reveals correlations in asset portfolios. By identifying these foundational risk relationships, professionals can navigate market complexities more adeptly, akin to understanding the best LEGO block placements for a sturdy structure.