Mathematical Principles and Quantitative Finance · 29. septembre 2024

In finance, matrices are essential for organizing and analyzing data like asset returns, correlations, and risks. They allow for compact manipulation of complex relationships, aiding in portfolio analysis, derivative pricing, and investment optimization.

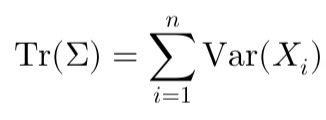

A key matrix is the covariance matrix, Σ (Sigma), which captures how asset returns vary individually and with each other.

Mathematical Principles and Quantitative Finance · 01. novembre 2023

The Jacobi method is a mathematical algorithm used to simplify complex matrices into a form that's easier to analyze, often for assessing risks and relationships in financial portfolios.