Stochastic Models and Processes · 05. mars 2025

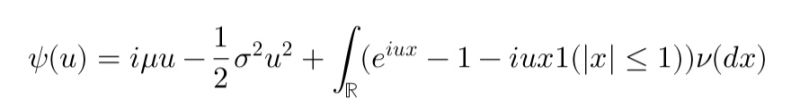

A Lévy process is a fundamental concept in probability theory and financial mathematics, extending Brownian motion by incorporating both continuous movements and discontinuous jumps. Characterized by independent and stationary increments, Lévy processes play a crucial role in modeling financial assets with sudden price changes, making them widely used in quantitative finance, risk management, and option pricing.

Pricing and Valuing Financial Instruments · 11. novembre 2023

The Jump-to-Default Approach in option trading, modeled by an SDE, highlights how sudden stock price drops (J) affect low strike call options, especially under high credit risk. This contrasts with the Black-Scholes model, which assumes continuous price movements. In high-risk scenarios, the market often lowers the value of these options, factoring in potential defaults, and adjusts implied volatility accordingly. #OptionPricing #CreditRisk #FinancialMarkets #TradingStrategies #InvestmentRisk

Stochastic Models and Processes · 10. novembre 2023

Convertible bonds blend debt and equity, featuring an option to convert into a set number of shares. Key factors include conversion ratio and price. Valuation hinges on stock dynamics, credit risk, and hazard rate. At maturity, value is the higher of face value or conversion outcome. Monte Carlo simulations help in pricing, considering callability and putability options. #ConvertibleBonds #CreditRisk #FinancialModeling #InvestmentStrategies