Principes mathématiques et applications en finance · 01. mars 2025

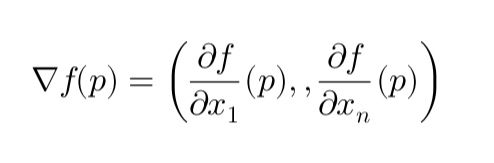

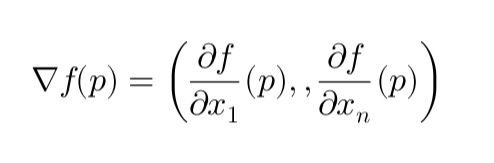

Cet article explique la descente de gradient en termes simples, en couvrant ses bases mathématiques et ses applications en finance, notamment dans la calibration du modèle de Hull-White pour la modélisation des taux d’intérêt. Il détaille le gradient, son rôle dans l’optimisation et la manière dont il minimise les erreurs de façon itérative. Les étapes clés de la calibration de la volatilité (σ) par descente de gradient sont présentées avec un exemple pratique.

Mathematical Principles and Quantitative Finance · 01. mars 2025

This article explains Gradient Descent in simple terms, covering its mathematical foundation and applications in finance, particularly in calibrating the Hull-White model for interest rate modeling. It breaks down the gradient, its role in optimization, and how it minimizes errors iteratively. Key steps in calibrating volatility (σ) using gradient descent are outlined with a practical example.

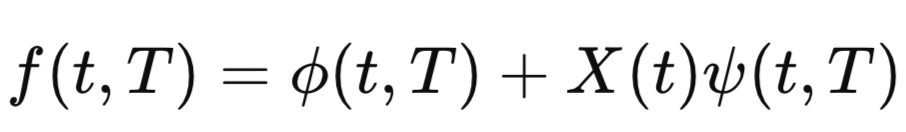

Stochastic Models and Processes · 03. novembre 2023

The Cheyette Model is a complex financial tool for predicting interest rate movements, accounting for time-varying mean reversion and volatility. It's more intricate than simpler models like Vasicek due to its detailed parameters, which makes it robust but computationally intensive and less commonly used in practice.