Processus et Modèles Stochastiques · 05. mars 2025

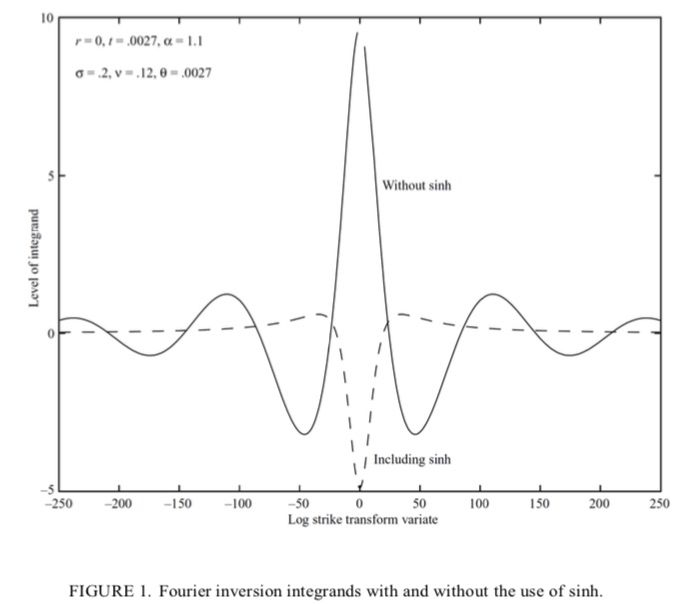

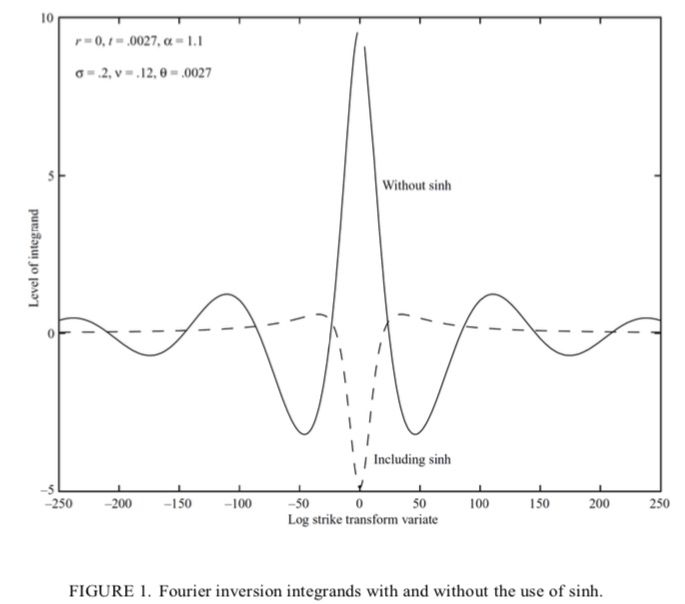

Découvrez comment la méthode de Carr & Madan exploite la transformée de Fourier pour la valorisation des options. Explorez les concepts clés, apprenez à atténuer les instabilités et améliorez les calculs numériques.

Pricing and Valuing Financial Instruments · 05. mars 2025

Learn how the Carr & Madan method leverages the Fourier Transform for option pricing. Discover key concepts, how to mitigate instabilities, and improve numerical computations.

Mathematical Principles and Quantitative Finance · 30. septembre 2024

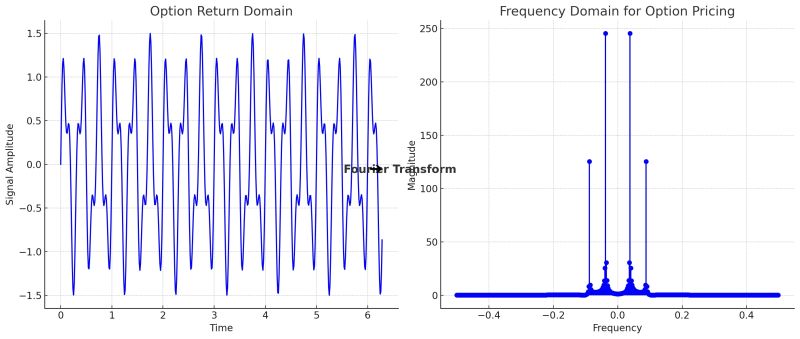

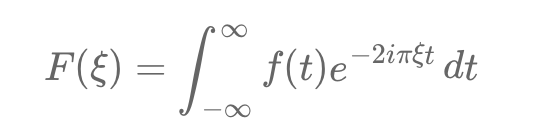

Option pricing, a key financial market challenge, relies on the Fourier transform to address complexities in valuation. An option grants the right to buy or sell an asset at a strike price, K, by expiration, T. The current price depends on the expected payoff, e.g., for a European call: max(S_T - K, 0). This is challenging as future asset prices follow complex stochastic processes.

The Fourier transform simplifies this by converting payoff calculations from time to frequency domain.

Pricing and Valuing Financial Instruments · 30. septembre 2024

Option pricing, a key financial market challenge, relies on the Fourier transform to address complexities in valuation. An option grants the right to buy or sell an asset at a strike price, K, by expiration, T. The current price depends on the expected payoff, e.g., for a European call: max(S_T - K, 0). This is challenging as future asset prices follow complex stochastic processes.

The Fourier transform simplifies this by converting payoff calculations from time to frequency domain.

Mathematical Principles and Quantitative Finance · 19. avril 2024

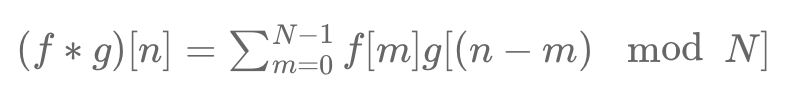

The trigonometric circle extends complex numbers, useful for visualizing periodic phenomena. In option pricing, the binomial model reflects market uncertainty through a tree structure. Fourier transforms help analyze future payoffs, using the characteristic function of the underlying asset's distribution. Circular convolutions connect binomial models and Fourier transforms, facilitating efficient computation of option prices.