13. novembre 2023

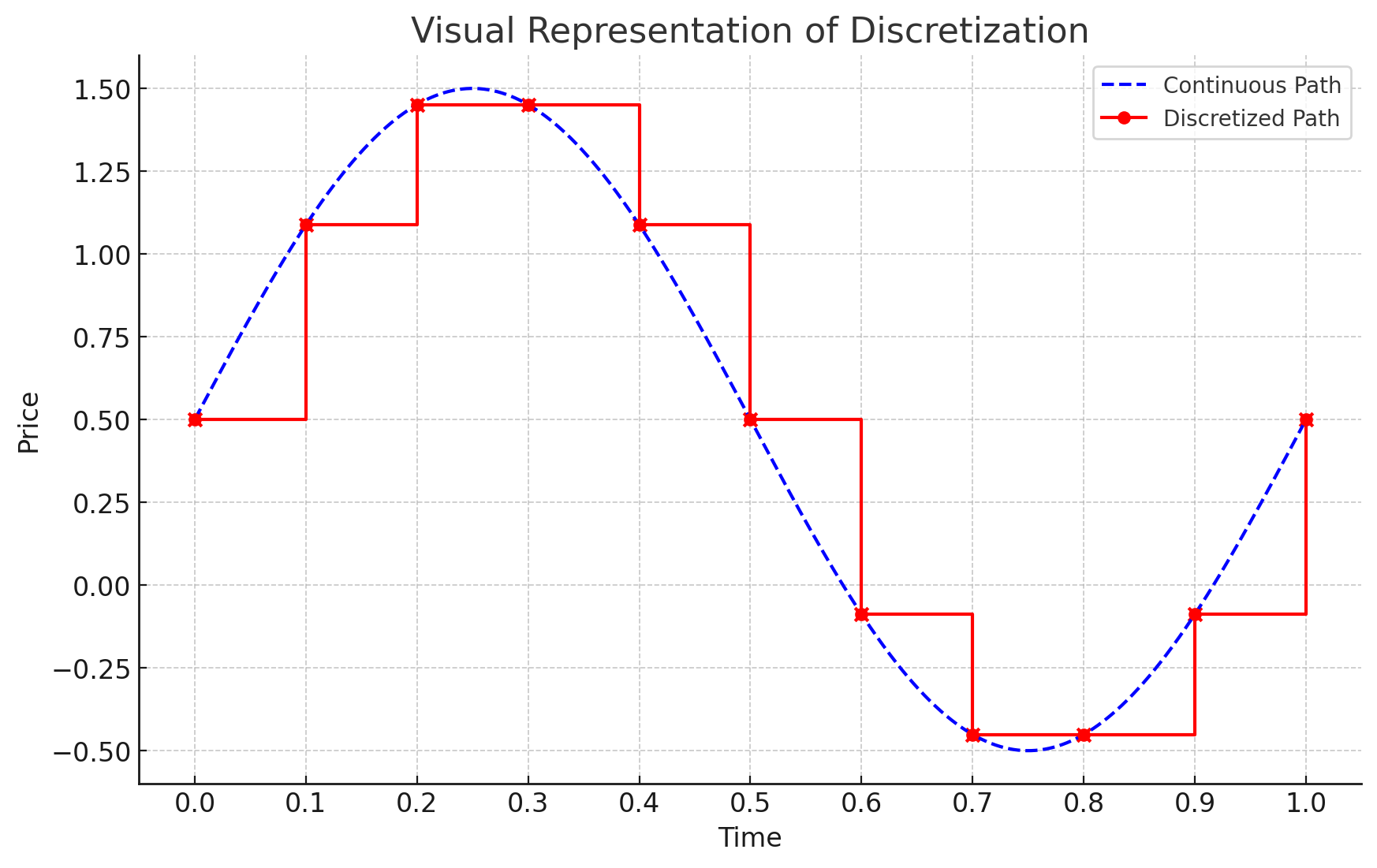

Discretization translates continuous financial models into numerically solvable steps, crucial for derivative pricing and risk management. It simplifies complex models, enabling simulations like Monte Carlo for exotic options while introducing some approximation error. #QuantitativeFinance #DerivativesPricing #NumericalMethods