Mathematical Principles and Quantitative Finance · 19. avril 2024

The trigonometric circle extends complex numbers, useful for visualizing periodic phenomena. In option pricing, the binomial model reflects market uncertainty through a tree structure. Fourier transforms help analyze future payoffs, using the characteristic function of the underlying asset's distribution. Circular convolutions connect binomial models and Fourier transforms, facilitating efficient computation of option prices.

Stochastic Models and Processes · 10. novembre 2023

Convertible bonds blend debt and equity, featuring an option to convert into a set number of shares. Key factors include conversion ratio and price. Valuation hinges on stock dynamics, credit risk, and hazard rate. At maturity, value is the higher of face value or conversion outcome. Monte Carlo simulations help in pricing, considering callability and putability options. #ConvertibleBonds #CreditRisk #FinancialModeling #InvestmentStrategies

Functioning of derivatives · 05. novembre 2023

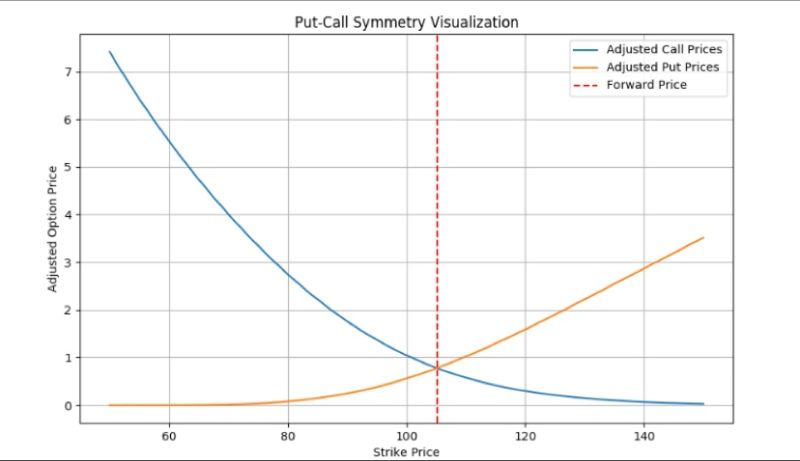

Put-Call Symmetry (PCS) links European put and call option prices via the forward price of the underlying asset. It requires frictionless markets, no arbitrage, zero drift, and symmetric asset returns. PCS is practical for pricing and hedging exotic options, offering a simpler alternative to dynamic hedging by balancing put and call strike prices against the forward price.