Risk Pricing · 10. juin 2024

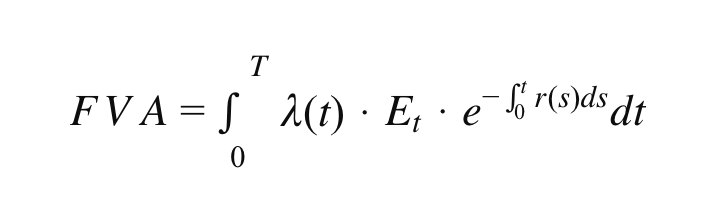

The Funding Valuation Adjustment (FVA) reflects the funding cost of uncollateralized derivatives above the risk-free rate, typically €STR or OIS in Europe. When a bank hedges an uncollateralized swap with a collateralized market swap, the difference between the internal funding cost and the benchmark rate results in either a negative or positive FVA. This adjustment directly affects the overall cost of hedging transactions.

Risk Pricing · 12. novembre 2023

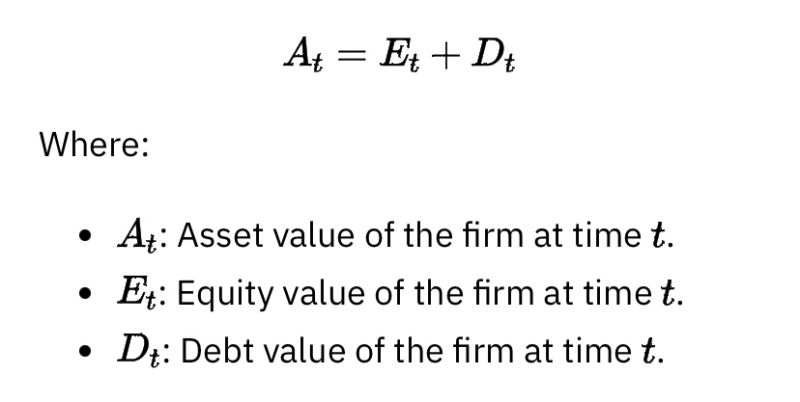

The Merton model, essential in credit risk analysis, views a company's equity as a call option on its assets, crucial for default probability assessment. Using the Black-Scholes formula, it combines equity with zero-coupon debt for valuation. Despite its innovativeness, the model's reliance on market data and idealistic market assumptions limit its applicability. This has spurred alternative approaches like reduced form models, addressing these shortcomings in credit risk evaluation.