Mathematical Principles and Quantitative Finance · 30. septembre 2024

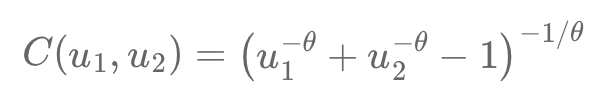

Copulas help model dependencies between variables separately from their behaviors, crucial for finance's complex relationships. For example, Alice and Bob’s race times show dependency when transformed into uniform variables using cumulative distribution functions (CDFs). The Clayton copula captures asymmetric dependence, especially in lower tail risks, using the formula:

C(u1, u2) = (u1^(-θ) + u2^(-θ) - 1)^(-1/θ).