Mathematical Principles and Quantitative Finance · 06. décembre 2024

Convexity is a crucial concept in finance, influencing bond pricing, options payoffs, and portfolio strategies. This article simplifies convexity by explaining its impact on financial models using practical examples. Learn how convexity amplifies variability, enhances returns in volatile markets, and ensures robust risk management.

Mathematical Principles and Quantitative Finance · 13. novembre 2023

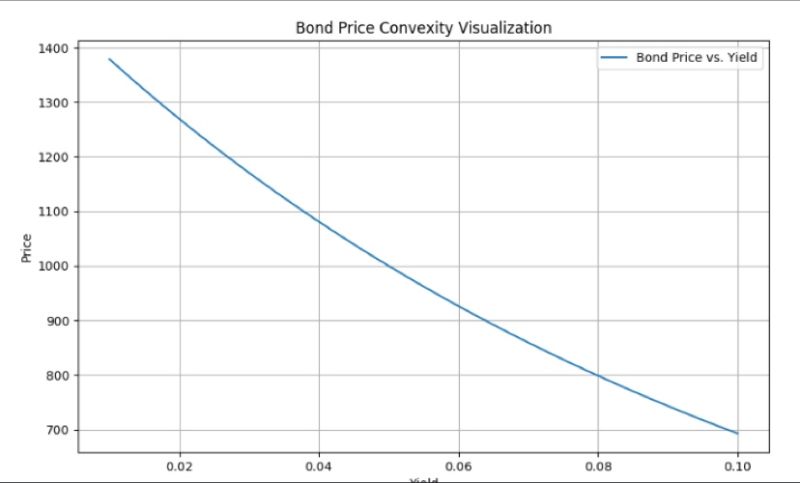

Bond convexity describes the curve-like relationship between bond prices and interest rates, causing prices to rise more when rates drop than they fall when rates rise. This curvature means bond price changes are not linear and convexity corrects pricing models, especially for large rate moves. #BondConvexity

Mathematical Principles and Quantitative Finance · 03. juin 2023

In finance, convexity enhances potential returns by amplifying gains from fluctuations in underlying assets. Jensen’s inequality shows that the expected payoff of a convex product like options is greater than that of linear products, making convexity crucial for pricing and investment strategies.