Pricing and Valuing Financial Instruments · 06. octobre 2024

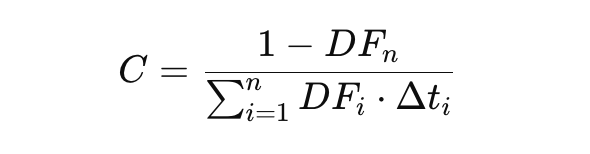

To price an interest rate swap (IRS), you find the fixed rate (C) that makes the present value of the fixed leg's cash flows equal to the floating leg's present value. The fixed leg's value is the sum of discounted fixed payments, while the floating leg approximates the notional principal.

Market Finance · 21. septembre 2024

In portfolio management, understanding "value added" (active return) is key to measuring performance relative to a benchmark. This outperformance is driven by two factors: asset allocation (how assets are distributed across classes) and security selection (the choice of specific assets). By comparing the portfolio’s return to the benchmark’s return, we calculate the total value added. Asset allocation considers how weight differences impact returns, while security selection isolates the effect

Statistics · 26. avril 2024

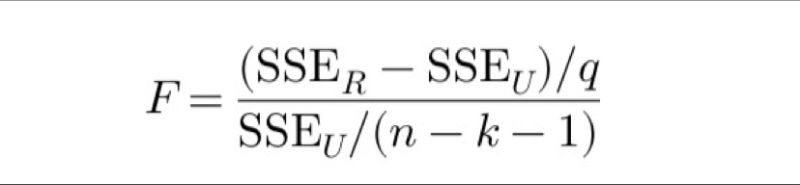

Regression analysis is vital for understanding relationships between variables, especially when assessing joint significance among multiple predictors. Using the joint F-statistic to compare restricted and unrestricted models in regression analysis, the null hypothesis assumes that excluded variables in the restricted model collectively have no significant effect on the dependent variable.