Mathematical Principles and Quantitative Finance · 29. juin 2024

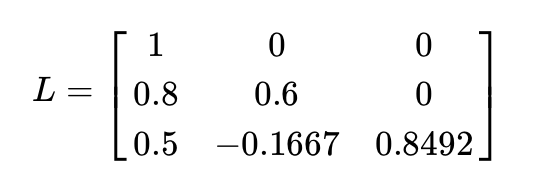

Cholesky decomposition plays a critical role in pricing Collateralized Debt Obligations (CDOs) by transforming independent variables into correlated ones based on a given correlation matrix. This method helps simulate scenarios of correlated defaults, essential for assessing risks and determining expected losses in CDO tranches.