Stochastic Models and Processes · 14. novembre 2023

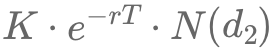

In the Black-Scholes model, N(d2) calculates the probability of a call option being in the money at expiration, balancing its potential profitability and expected exercising cost. This risk-neutral measure assumes investments grow at a risk-free rate, crucial for arbitrage-free option pricing. #BlackScholesModel #RiskNeutralValuation #OptionPricing #N(d2)Explained