Risk Pricing · 12. novembre 2023

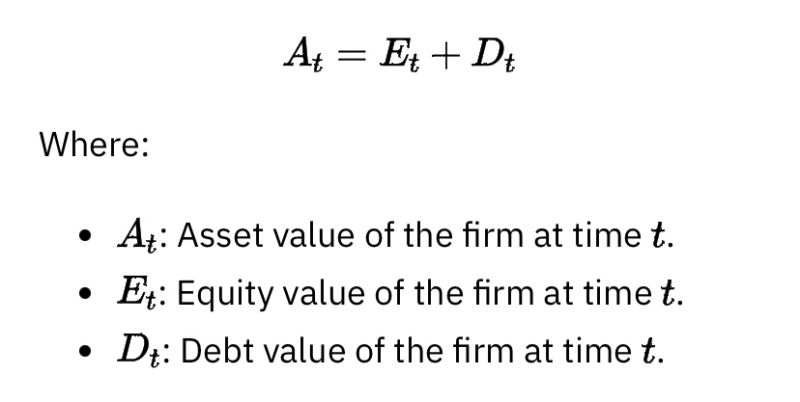

The Merton model, essential in credit risk analysis, views a company's equity as a call option on its assets, crucial for default probability assessment. Using the Black-Scholes formula, it combines equity with zero-coupon debt for valuation. Despite its innovativeness, the model's reliance on market data and idealistic market assumptions limit its applicability. This has spurred alternative approaches like reduced form models, addressing these shortcomings in credit risk evaluation.

08. juillet 2023

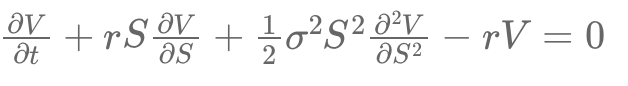

The Black-Scholes partial differential equation in layman’s terms…

#OptionPricing, #BlackScholes, #FinancialModeling, #QuantitativeFinance, #RiskNeutralMeasure

Processus et Modèles Stochastiques · 11. février 2023

The Black-Scholes model calculates the fair price of a European call option on a non-dividend-paying stock by creating a risk-free hedging portfolio. Using Itô's Lemma and stock price dynamics, it derives the Black-Scholes PDE, a cornerstone for option pricing under a no-arbitrage framework.