- Accueil

- Home

- Training Catalog-2023

- Training courses

- MISSION EXAMPLES

- CONTACT

- Blog

- I. Stochastic Models and Processes

- II. Mathematical Tools and Principles

- III. Quantitative Finance Applications

- IV. Advanced Concepts and Theories

- V. Technical Methods and Interpolations

- VI. Miscellaneous Quant Topics

- VIII. Quant Interview Questions

- VII. Data Science and Technology in Finance

- Behavorial finance

- Corporate finance

- Quizzes

- Webinars

- The Layman’s Quant Lexicon

III. Quantitative Finance Applications · 07. février 2024

Explore the hypercube's critical role in CDO risk modeling within quantitative finance. A hypercube extends a 2D square or 3D cube into an N-dimensional space, each axis representing a financial asset's cumulative distribution in copula functions. It's pivotal for visualizing complex dependencies in a CDO, where each axis indicates the default probability of different assets.

I. Stochastic Models and Processes · 12. novembre 2023

The Merton model, essential in credit risk analysis, views a company's equity as a call option on its assets, crucial for default probability assessment. Using the Black-Scholes formula, it combines equity with zero-coupon debt for valuation. Despite its innovativeness, the model's reliance on market data and idealistic market assumptions limit its applicability. This has spurred alternative approaches like reduced form models, addressing these shortcomings in credit risk evaluation.

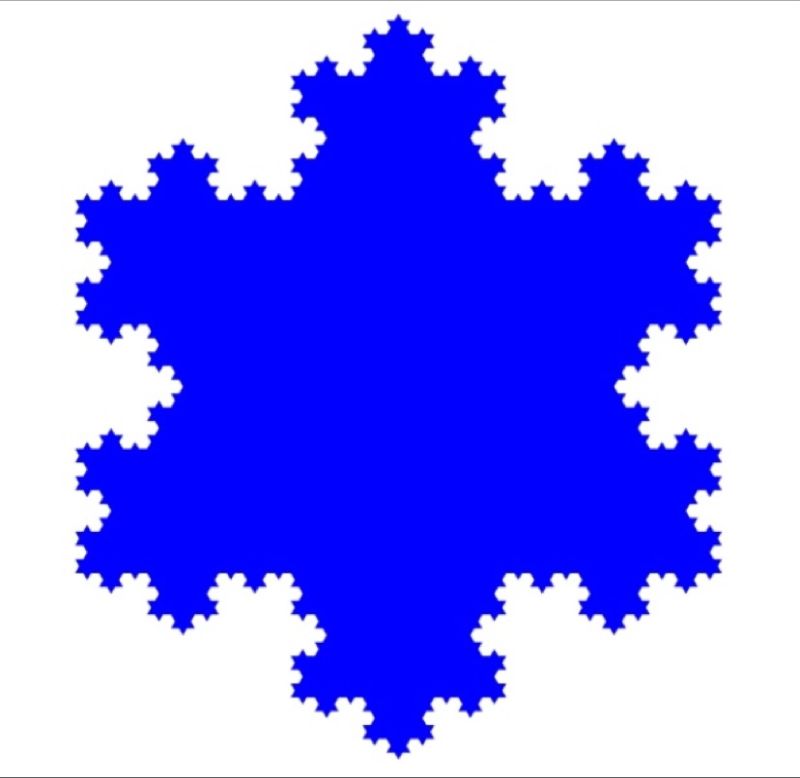

IV. Advanced Concepts and Theories · 06. novembre 2023

Benoit Mandelbrot revolutionized finance with his fractal geometry insights, revealing that market prices are rough and self-similar across time scales, not smooth as traditional models suggest. His work, inspired by Hurst's Nile studies, shows markets exhibit 'wild randomness' with frequent large swings. Mandelbrot's methods, using the Hurst exponent, offer a new model for capturing the actual volatility and trends in financial markets. #Mandelbrot #Fractals #Finance #MarketVolatility