Collateralized Debt Obligations (CDOs) are complex financial instruments that bundle various loans, bonds, or other debt instruments into a single security, divided into tranches with different

risk levels and returns. The performance of these tranches depends on the default risk of the underlying assets, and correlation plays a crucial role in this context.

Compound correlation (or implied correlation), commonly used in CDO pricing, assesses each tranche independently.

The structure of CDOs into tranches with varying risk and return levels means that correlation impacts each tranche differently.

For example, the equity tranche has decreasing sensitivity to an increasing correlation, while the senior tranche has increasing sensitivity to an increasing correlation. *

However, this method has significant drawbacks:

- By treating each tranche separately, compound correlation fails to account for the interdependencies between tranches, leading to a potentially misleading risk profile.

- Compound correlation doesn't ensure that the sum of losses across all tranches equals the total portfolio loss, which can result in mispricing.

- Implied correlations vary across tranches, indicating that a single correlation value cannot accurately represent the entire default probability distribution. This complicates both pricing and risk management.

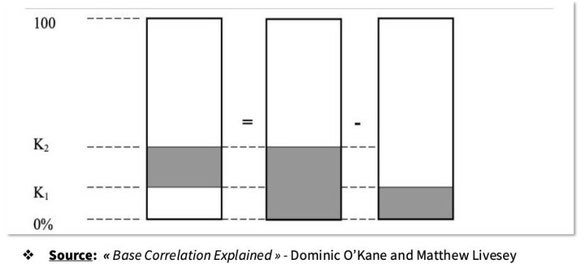

Base correlation provides a more coherent approach to understanding and managing the risk of CDO tranches by decomposing them into combinations of base tranches, particularly theequitytranche.

Here’swhy base correlation is advantageous:

The term "base" refers to the equity tranche, which has zero subordination. This means it is the first to absorb any

losses,sitting at the base of the loss distribution.

Base correlation maintains the expectation that the sum of losses across all tranches equals the total portfolio loss, ensuring more accurate pricing. Unlike compound correlation, base

correlation considers the interdependencies between tranches, providing a clearer and more consistent risk assessment.

(*) This can be explained by the fact that as correlation increases between tranches, the probability of either all

tranches defaulting or none of them defaulting increases. This places the senior tranche in a situation where it is much less protected compared to a situation where the correlation is close to

zero, and the equity tranche is more likely to absorb losses first.

Écrire commentaire