Inequalities are essential tools in quantitative finance, enabling analysts and researchers to bound risks, assess uncertainties, and optimize financial models. Each inequality offers unique insights into random variables, providing frameworks for decision-making in stochastic environments.

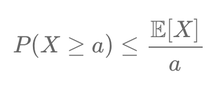

Markov's inequality establishes an upper bound on the probability that a non-negative random variable \( X \) exceeds a specified threshold \( a > 0 \):

\[ P(X \geq a) \leq \frac{\mathbb{E}[X]}{a} \]

Implication: In risk management, Markov's inequality helps quantify the worst-case probability of extreme losses in a portfolio when only the expected value is known. For example, if a portfolio's expected loss is \( \mathbb{E}[X] = 1,000 \) and we wish to estimate the probability of a loss exceeding \( 5,000 \), Markov's inequality provides:

\[ P(X \geq 5,000) \leq \frac{1,000}{5,000} = 0.2. \]

This result indicates that there is at most a 20% chance of such extreme losses occurring.

Chebyshev's inequality refines Markov's result by incorporating variance, thus providing a tighter bound on the probability of deviations from the mean:

\[ P(|X - \mu| \geq k \sigma) \leq \frac{1}{k^2}. \]

Implication: This inequality is particularly useful in portfolio analysis to measure the dispersion of returns. For instance, if a portfolio has an expected return \( \mu = 5\% \) and standard deviation \( \sigma = 2\% \), the probability that returns deviate by more than \( 4\% \) is bounded by:

\[ P(|X - 5| \geq 4) \leq \frac{1}{(2)^2} = 0.25. \]

This means there is at most a 25% chance of returns falling outside the range of \( 1\% \) to \( 9\% \).

Jensen's inequality highlights the relationship between convex functions and expectations. For a convex function \( f \) and a random variable \( X \):

\[ f(\mathbb{E}[X]) \leq \mathbb{E}[f(X)]. \]

Implication: This inequality is central to utility theory in finance, where the utility function \( U(x) \) is often concave for risk-averse investors. For example, if \( X \) represents the return of a risky portfolio and \( U(x) = \sqrt{x} \), then:

\[ \sqrt{\mathbb{E}[X]} \leq \mathbb{E}[\sqrt{X}]. \]

This demonstrates that the expected utility of a portfolio's return is greater than the utility of its expected return, emphasizing the investor's preference for diversification.

Holder's inequality generalizes the Cauchy-Schwarz inequality, bounding expectations and integrals. For \( p > 1 \) and \( q \) such that \( \frac{1}{p} + \frac{1}{q} = 1 \):

\[ \mathbb{E}[|XY|] \leq (\mathbb{E}[|X|^p])^{1/p} (\mathbb{E}[|Y|^q])^{1/q}. \]

Implication: In derivative pricing, Holder's inequality helps bound the payoff expectations of options. For instance, if \( X \) represents an option's payoff and \( Y \) is a pricing kernel, this inequality ensures the stability of numerical approximations in pricing algorithms.

Doob's inequality provides bounds for the maximum value a Martingale can reach. For a Martingale \( M_t \) and \( \lambda > 0 \):

\[ P\left(\sup_{t \leq T} |M_t| \geq \lambda \right) \leq \frac{\mathbb{E}[|M_T|]}{\lambda}. \]

Implication: This inequality is critical in risk management to estimate the likelihood of extreme deviations in hedging strategies. It provides a practical framework for controlling the tail risks of dynamic portfolios.

These inequalities form the backbone of quantitative finance, offering rigorous mathematical tools for bounding probabilities, managing risks, and refining financial models. By quantifying uncertainties, they help practitioners build robust, reliable frameworks for decision-making in stochastic markets.

1 Inequalities like Markov's and Chebyshev's provide essential bounds for tail risks, aiding in portfolio construction and risk analysis.

Écrire commentaire